If you rent out your property on a short-term basis, you must understand and follow the regulations that govern this industry. The laws ensure guest safety, safeguard community standards, and help you avoid fines and legal problems. We’ve put together this guide so you can stay on top of all short-term rental regulations and run your rental smoothly.

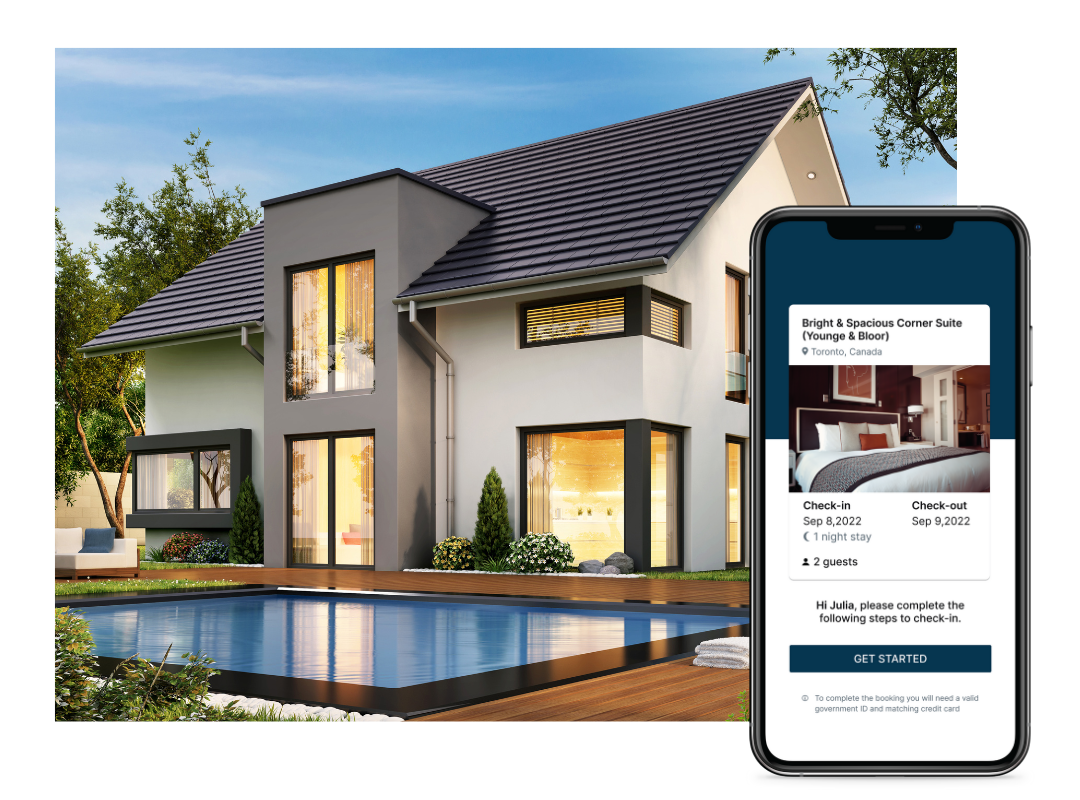

What is Short Term Rentals?

Short-term rentals, often known as vacation rentals, are properties rented out for a brief period, typically less than 30 days. Examples include renting out your home on platforms like Airbnb or VRBO. Unlike long-term rentals, which involve leases of six months or more, short-term rentals cater to travelers and tourists looking for temporary lodging.

Short-term rentals can range from a single room in your home to entire houses or apartments. They offer flexibility for both the host and the guest, but this flexibility comes with specific regulatory requirements that must be met. Understanding these requirements is key to running a successful and legal short-term rental business.

Why Short Term Rental Regulations Matter?

Protecting Community Standards:

Regulations ensure that short-term rentals do not negatively impact the local community. They help maintain the character of neighborhoods and prevent issues like noise disturbances, overcrowding, and parking problems. By following these rules, you contribute to a positive relationship with your neighbors and support the overall well-being of the community.

Ensuring Safety and Quality for Guests:

Regulations often include safety standards, such as fire codes and health inspections, ensuring that properties are safe and habitable for guests. This protects your guests and minimizes your liability as a host.

Avoiding Fines and Legal Issues:

Non-compliance with local regulations can result in hefty fines, legal battles, and even the closure of your rental. By understanding and following the rules, you can avoid these issues and run a successful rental business.

Understanding Short Term Rental Laws

Short-term rental laws can be a bit of a maze, but getting a handle on them is essential. Let’s break down the key aspects you need to know:

Overview of General Laws Affecting Short-Term Rentals:

Generally, these laws cover safety, zoning, and taxation. Safety regulations ensure that your property meets basic health and safety standards, such as having working smoke detectors and fire extinguishers. Zoning laws dictate where short-term rentals are allowed to operate, preventing them from popping up in areas not designated for such use. Tax laws require you to report rental income and possibly collect occupancy taxes, similar to what hotels pay.

Common Legal Requirements for Hosts:

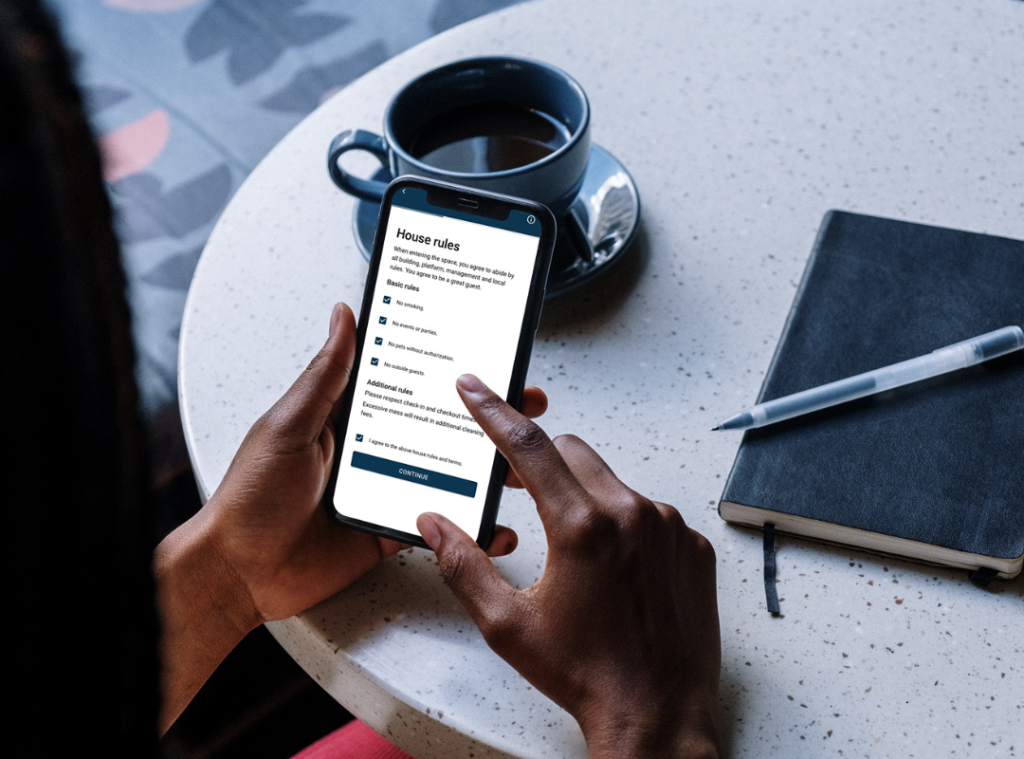

Most places require you to register your property with the local government. This often means filling out forms and paying a fee. You might also need a business license, especially if you rent out multiple properties or do so frequently. Many areas have specific insurance requirements to ensure you’re covered in case of guest injuries or property damage. Be sure to check if there are rules about having guests sign a rental agreement, which can help protect you legally.

How These Laws Vary by Location?

Laws can vary widely depending on where your property is located. For instance, some cities require hosts to live on-site or limit the number of nights a property can be rented out each year. Others might ban short-term rentals entirely in certain neighborhoods. It’s important to research the specific regulations in your area to ensure compliance.

Short Term Rental Rules by Region

Different regions have their own sets of rules for short-term rentals. Here’s a look at some regional differences and specific examples:

In general, urban areas tend to have stricter regulations due to concerns about housing availability and neighborhood impact. Tourist-heavy areas might focus more on safety and managing the influx of visitors.

Specific Examples of Regulations in Major Cities:

– New York:

New York City has some of the strictest short-term rental laws. You can’t rent out an entire apartment for less than 30 days unless you, the host, are also staying there. This law aims to prevent the loss of long-term housing to short-term rentals.

– Los Angeles:

In LA, you need to register your property and comply with various safety regulations. There’s also a cap on the number of days you can rent out your property each year unless you get a special permit.

– San Francisco:

San Francisco requires hosts to register with the city and adhere to strict rules on how often a property can be rented. They also have specific guidelines on what information must be provided to guests.

Impact of Local Government Policies:

Local governments play a significant role in shaping short-term rental regulations. Their policies can influence everything from the availability of rental properties to the types of guests that are attracted to the area. Staying informed about local policies is crucial for compliance and can help you adapt to any changes.

Vacation Rental Rules: Key Considerations:

Vacation rental rules often overlap with short-term rental regulations but can have unique considerations due to their nature:

Zoning Laws and Their Impact on Vacation Rentals:

Zoning laws dictate where vacation rentals can operate. In some areas, they might be restricted to specific zones or banned entirely. It’s essential to check your local zoning laws to ensure your property is in a permitted area.

Occupancy Limits and Guest Restrictions:

Many places have rules about how many guests can stay in a rental at one time. These rules are often based on the size of the property and are meant to prevent overcrowding and ensure safety. For example, a two-bedroom apartment might have a maximum occupancy of four guests.

Tax Implications and Responsibilities:

Short-term rental income is usually subject to taxes, including income tax, sales tax, and local occupancy taxes. Hosts must understand their tax obligations and ensure they are collecting and remitting the appropriate taxes. Some areas might require you to pay these taxes quarterly or annually, so keeping accurate records is crucial.

Licensing and Permits for Short Term Rentals

To operate legally, you often need to obtain the proper licenses and permits. Here’s what you should know:

Types of Licenses and Permits Required:

The specific licenses and permits you need can vary but generally include a business license and a short-term rental permit. Some places also require health and safety inspections before you can rent out your property.

Application Processes and Fees:

Applying for these licenses usually involves filling out an application form, paying a fee, and providing documentation about your property. This can include proof of insurance, a floor plan, and sometimes a background check.

Renewal Requirements and Timelines:

Licenses and permits often need to be renewed periodically, usually every one to two years. Renewal might involve paying another fee and confirming that your property still meets all regulatory requirements. Staying on top of renewal deadlines is important to avoid lapses in your ability to rent out your property.

Compliance and Enforcement

Staying compliant with short-term rental regulations is crucial, not just for avoiding fines but also for maintaining a good reputation. Here’s what you need to know about compliance and enforcement:

How Regulations Are Enforced:

Local authorities enforce short-term rental regulations through various methods. This can include routine inspections, rental monitoring platforms, and responding to complaints from neighbors. Some cities have dedicated teams that track down unregistered rentals and ensure compliance.

Penalties for Non-Compliance:

The penalties for not following the rules can be severe. They might include hefty fines, legal action, or even a ban on renting out your property. For instance, if you operate without the required permits, you could face fines ranging from hundreds to thousands of dollars. Repeat offenses can lead to more severe consequences, including court cases or forced closure of your rental.

Tips for Staying Compliant:

To stay on the right side of the law, make sure to keep up with local regulations. Regularly check for updates, maintain all necessary permits and licenses, and ensure your property meets safety standards. It’s also a good idea to keep detailed records of your rental activities, including guest information and tax payments, to show you’re operating above board.

Navigating Changes in Short Term Rental Regulations

Regulations for short-term rentals are constantly evolving, so staying informed is essential. Here’s how to navigate these changes:

Keeping Up with Regulatory Changes:

One of the best ways to stay updated is by joining local short-term rental associations or groups. These organizations often provide updates on regulatory changes and offer resources to help hosts comply. Additionally, regularly checking local government websites or subscribing to relevant newsletters can keep you informed.

Resources for Staying Informed:

There are several resources you can use to stay on top of regulatory changes. Online forums and social media groups for hosts are great for sharing information and experiences. Many cities also offer workshops or information sessions for short-term rental hosts, providing valuable insights into current and upcoming regulations.

Adapting to New Rules and Regulations:

When new regulations are introduced, it’s important to adapt quickly. This might mean applying for new permits, updating your property to meet new safety standards, or adjusting your rental practices. Being proactive rather than reactive can save you from potential fines and disruptions to your rental business.

Understanding and complying with short-term rental regulations is key to running a successful and legal rental business. By staying informed and proactive, you can navigate the complex landscape of regulations and keep your rental operation smooth and hassle-free.