Scams have become more sophisticated and widespread in today’s digital age. Sadly, the rental market is not exempt from this trend. Property managers often find themselves in the crosshairs of these swindlers. What if you could stay one step ahead? What if you could arm yourself with knowledge to safeguard your properties and tenants? Dive deep with us as we unveil 45 of the most notorious renting scams.

1. The Too-Good-to-Be-True Listing

Have you ever come across a rental listing with a jaw-droppingly low price for a luxurious property? Tempting, right? This scam begins with scammers copying real listings, tweaking the details, and slashing the price. They lure in hopeful tenants, only to disappear once they’ve received a deposit.

Pro Tip: Compare listings. If it looks familiar or is priced suspiciously low, trust your gut and investigate further.

2. The Phantom Rental

Imagine advertising space that doesn’t even exist! Sound ludicrous? Yet, some con artists are peddling non-existent properties. Using appealing photos and descriptions, they seduce prospective renters into paying a deposit or even the first month’s rent.

Tip: How often do you verify property existence before initiating a deal? Take the time to physically check or use trusted platforms.

3. The Bait-and-Switch

Here’s a tricky one: the property exists, but the details in the listing are exaggerated or entirely false. A renter might visit an apartment expecting a spacious two-bedroom only to find a cramped studio. By then, they might have already invested time and resources into the move.

Ask yourself: How transparent are you in your listings? Honesty not only builds trust but shields you from unintentional bait-and-switch accusations.

4. Overpayment Scheme

It starts innocently enough. A prospective tenant sends a check over the agreed amount. Then, they come up with a plausible excuse and ask you to refund the excess. But here’s the catch: their original check is fraudulent. By the time it bounces, you’ve already sent real money back.

Tip: Are you swift to cash checks and make refunds? Patience is key. Always ensure funds are clear before making any financial moves.

5. The Middleman Con

This one’s audacious. Scammers pose as intermediaries or agents representing property owners. They collect fees, deposits, even rents, promising to transfer them to the actual owners. However, once they get the money, they vanish into thin air.

Ponder this: How often do you assess the authenticity of middlemen? A bit of scrutiny can save you a lot of hassle and money.

The world of rental property management is fraught with challenges, but with knowledge as your ally, you’re well-equipped to face them. Remember, awareness is the first step towards prevention. In the subsequent sections, we’ll delve deeper into more intricate scams and offer actionable insights to bolster your defenses.

6. The Sob Story Subterfuge

We’ve all heard them – heart-wrenching tales of hardship. While many are genuine, some tenants craft masterful stories to gain your sympathy, delay rent, or even negotiate lower payments. They bank on your compassion to bypass regular protocols.

Contemplate: Do you often let emotions cloud your judgment? Establishing a standard procedure and sticking to it, regardless of the tales you hear, can be crucial.

7. The Forged Document Dodge

In this tech-savvy era, forging documents like pay stubs, bank statements, or reference letters is easier than ever. With these counterfeit documents, scammers can make themselves appear as ideal tenants when their financial reality tells a different story.

Quick Check: How often do you cross-verify the authenticity of documents? Directly calling an employer or previous landlord can reveal more than any paper ever will.

8. Illegal Subletting Scheme

Some tenants might rent your property with the sole intent of subletting it, often at a higher rate, without your knowledge or consent. Theya pocket the difference and may leave you with a damaged property or unauthorized tenants.

Worth Noting: Have you clarified your subletting policies? Make sure your lease agreements explicitly state your terms regarding subletting.

9. The Damage Deception

Damage deposits are standard in rental agreements. But some renters try to get crafty by hiding damage they’ve caused, only for it to be discovered later. From cheap patch-up jobs to hiding broken items, the objective is to retrieve their full deposit.

Food for Thought: How thorough are your property inspections? Regular check-ins and meticulous move-out examinations can prevent this.

10. The Never-Ending Guest Gimmick

A tenant might introduce someone as a ‘temporary guest’ who ends up living in the property indefinitely, bypassing background checks or additional rent. This not only breaches the lease agreement but might also introduce safety risks.

Puzzle this out: How clear are you about the definition of a ‘guest’ in your rental agreement? Establish and communicate guidelines for guest stays.

11. Identity Theft Intrigue

Renting provides fraudsters an opportunity to gather your personal or business information. These tenants can then misuse this data for various scams, from credit card frauds to other financial deceptions.

Reflect: How secure is the tenant information you store? Ensure robust data protection practices, and be wary of sharing personal or business details.

12. Rent Check Roulette

This is a classic one: a tenant consistently writes bad checks. By the time the checks bounce, they’ve bought themselves a few more days or weeks in the property. They play the delay game until eviction, giving them a free stay at your expense.

Here’s a thought: Do you accept electronic payments? They’re quicker and more reliable than traditional checks, reducing the chances of this scam.

13. The Lease-terminator Loophole

Some cunning tenants search for minor, often overlooked flaws in lease agreements. They then use these minor discrepancies or unenforceable clauses to challenge the lease, sometimes even demanding concessions or threatening legal action.

Dig Deep: How often do you review your lease templates? Regularly consulting with a legal expert to ensure your lease is watertight can save you future headaches.

14. Utility Dodge Dance

Utility bills can accumulate quickly. Some fraudulent renters might transfer utilities to your name without your knowledge or consent. By the time you notice, you’re faced with a hefty bill.

Ask Yourself: Are utility responsibilities clearly defined in your lease? Regularly monitoring your credit or setting up alerts can help you spot unauthorized changes.

15. The Deposit Double-Dip

In this trick, tenants claim they never received their security deposit back, even if you’ve already returned it. They might produce doctored bank statements as ‘proof’ and demand reimbursement.

Consider: Do you provide clear receipts for returned deposits? Using traceable payment methods can act as concrete evidence against such claims.

16. The Professional Squatter

These are tenants who understand eviction laws inside out. They occupy a space, stop paying rent, and when faced with eviction, they exploit every legal loophole to prolong their stay without paying a dime.

Ponder On: How well do you know your region’s eviction laws? Being well-versed can help you act swiftly and decisively against such tenants.

17. Renovation Ruse

Some tenants might make unauthorized alterations or renovations to the property, claiming it’s for ‘improvement.’ Later, they demand deductions in rent or even ask for reimbursement for the ‘value’ they’ve added.

Reflect: How clear are your terms regarding property modifications? Regular property inspections can catch unauthorized changes early on.

18. Pet Policy Play

Even with a no-pet policy, some tenants smuggle in their furry friends. They may lie initially or even attempt to present fake emotional support animal (ESA) documentation to avoid additional fees or bypass rules.

Here’s a Thought: How stringent is your pet verification process? Consider implementing clear guidelines and penalties for violations.

19. Referral Rip-off

To secure a rental, some renters present fake referrals or even friends posing as former landlords who vouch for their credibility. These counterfeit references paint them in a favorable light, masking potential issues.

Pro Tip: Always do your due diligence. A quick online search of the reference or using third-party verification services can uncover deceit.

Being a property manager requires a judicious mix of people skills, business acumen, and an eye for detail. It’s like navigating a ship through tricky waters – the vast ocean of tenants is mostly calm and genuine, but there are occasional turbulent patches.

Here are some additional crafty maneuvers tenants might pull, further emphasizing the need for vigilance.

20. The Overpaying Check Gambit

It’s oddly reminiscent of receiving a larger denomination bill in a transaction and getting hustled during change-giving. Some renters write a check bigger than the required move-in amount. Then, they’ll quickly ask for a refund, usually before their initial check bounces.

Question Time: Do you usually wait for checks to clear? As a rule of thumb, always do – and especially before issuing any refunds.

21. Employment Evasions

False employment records can paint a rosy picture of a tenant’s financial status. With fabricated job titles, inflated salaries, or entirely non-existent companies, they try to establish credibility and financial stability.

Note to Self: A quick call to the mentioned employer, or even an online search, can be instrumental in cross-verifying employment claims.

22. Crafted Credit Reports

A good credit score can be the golden ticket to securing a rental. But not all credit reports handed to you will be genuine. Some crafty tenants might present tampered or entirely fake credit reports to appear financially sound.

Pro Insight: Instead of accepting tenant-provided reports, consider running your own credit checks through trusted agencies.

23. Masquerading as the Middleman

This one’s a slight twist on earlier discussed frauds: Here, the tenant claims to be renting on behalf of the actual owner, perhaps suggesting the ‘owner’ is abroad or otherwise indisposed. They might collect rents and deposits, leaving both you and the real owner in a bind.

Ponder: How well do you know the property owners you deal with? Establishing direct communication lines can prevent such confusions.

24. Deceptive Pay Stubs

In the age of easily accessible editing tools, creating a fake pay stub is a breeze. Tenants might use these to overstate their income, suggesting they can comfortably afford the rent when that might not be the case.

Reflection: As with employment records, a simple verification call to the employer can often clear the air. Authenticity is everything.

25. Eviction Evasion Exploits

Legal systems often have nuances, and some tenants know them too well. They might pull tricks to reset the eviction clock, like momentarily vacating the property or making partial payments. These actions can prolong their stay, causing financial strain on the property manager.

Takeaway: Being knowledgeable about local eviction laws and consulting with legal experts can help in navigating these murky waters.

26. Listing Larceny

Your hard work in crafting a perfect property listing can be stolen by scammers. They’ll use your photos and details but modify contact information, trying to reroute potential tenants to themselves, often with an enticingly lower rent.

Golden Rule: Regularly monitor popular listing sites. If you spot duplicates of your listings, report them immediately.

The rental journey is one of trust and mutual understanding. However, the trail is occasionally dotted with pitfalls, some more elusive than others. Continuing our deep dive into the realm of rental fraud, we highlight a fresh batch of tenant scams that might just catch property managers off-guard if they’re not adequately informed.

Duplicate Listing Deception: A Costly Scam for Property Managers

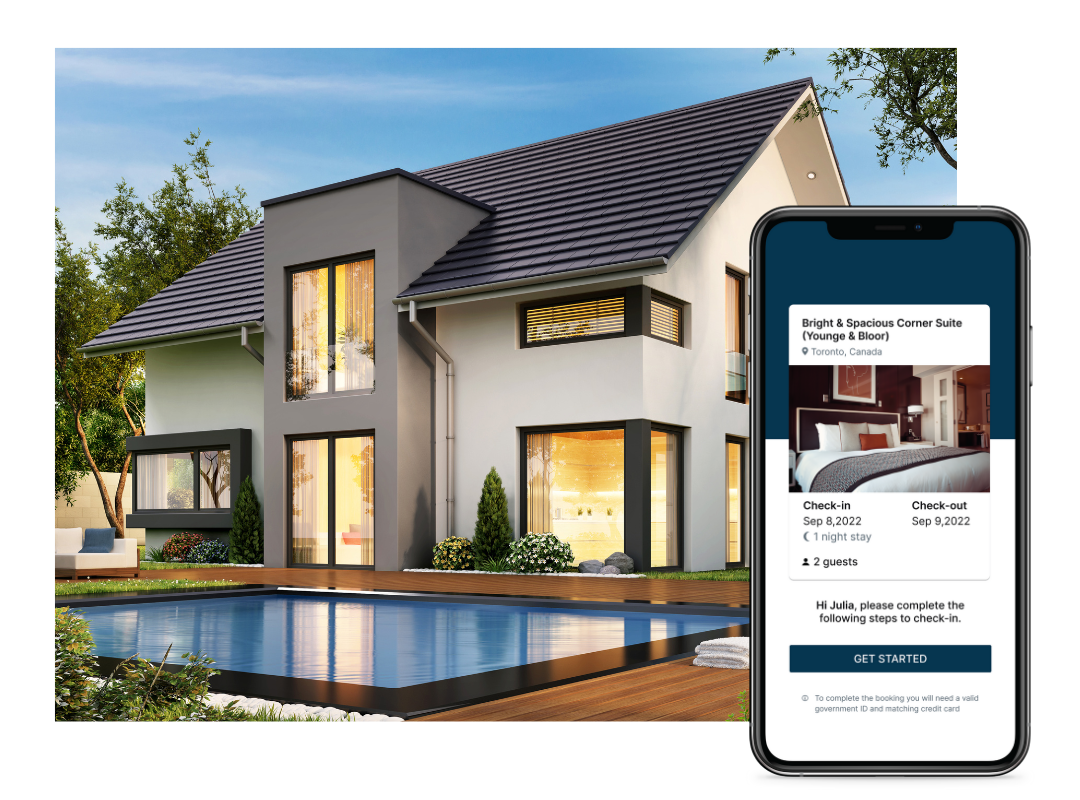

One of the most deceptive rental scams is duplicate listing deception, where fraudsters copy legitimate property listings and repost them with altered details. These scammers often change contact information, lower the rental price to lure in unsuspecting tenants, and collect deposits before disappearing. This scam not only confuses renters but can also damage a property manager’s reputation when frustrated applicants contact them about fake listings. To combat this, property managers should regularly monitor rental platforms for duplicate listings, use watermarking on photos, and ensure their official contact details are clearly listed. Quick action in reporting fraudulent listings can help prevent financial losses and tenant frustration.

27. Rewriting Rental Histories

A stellar rental history can work wonders for a tenant’s application. Aware of this, some crafty renters present doctored or entirely false rental history verifications. This masks past issues, ensuring they come across as perfect potential tenants.

Deliberation: How thorough is your background check? Direct conversations with previous landlords or using trusted verification services can be a safeguard.

28. Commercial Ambitions in Residential Zones

Your residential property might unknowingly transform into a buzzing commercial hub. Some tenants, without explicit permission, might start using residential spaces for commercial activities – from running online businesses to setting up makeshift workshops.

Musing: Are your lease terms crystal clear about the allowed usage of the property? Regular inspections can give you insights into any unauthorized activities.

29. The Phantom Rent Payer

Some tenants enter a property with zero intention of ever paying the rent. Their goal? Enjoy as many days of free stay as possible before inevitable eviction. They’re master procrastinators, often offering countless excuses.

Think About: How robust is your initial tenant screening process? A tighter vetting procedure can help filter out potential defaulters.

30. Stealthy Exit Strategies

When it’s time to leave, some tenants might become masters of illusion, adeptly hiding property damages in hopes of retrieving their full security deposit. This can range from artfully placed furniture over stained carpets to strategic lighting hiding wall damages.

Insight: A detailed move-in/move-out checklist, complete with photographs, can be your best ally against such concealments.

31. The Hasty Renter Riddle

While a keen interest in a property is great, an unexplained urgency to rent can sometimes be a red flag. These renters might want to quickly secure a place before any background checks reveal discrepancies in their applications.

Question: Do you always ensure a consistent vetting pace, irrespective of a tenant’s urgency?

32. The Mystery of the Missing Co-tenant

While a tenant might declare living solo, they could secretly be housing co-tenants – individuals not vetted or mentioned in the lease. This poses potential security and liability issues.

Note: Is it time to re-emphasize the importance of declaring all occupants in your lease agreement? Spot checks and open communication can help.

33. The Service Animal Stratagem

While service animals are protected by law, some tenants might falsely claim their pet as a service animal to bypass pet fees or no-pet policies. They may even present questionable certifications from online sources.

Guideline: It’s essential to understand the legalities surrounding service animals. While you can’t charge fees, you can request documentation verifying the need for a service animal.

The realm of property management, like any other, evolves with time. As technology and processes advance, so do the methods employed by deceitful individuals. While we’ve covered a vast array of tactics, there are always a few more paths less explored, or newly treaded, in the world of rental scams. Here’s a further exploration:

34. Digital Deposit Dupes

In this age of digital payments, some tenants exploit the system by sending rent or deposits through apps that allow payment reversals. They might cancel the transaction after it appears in your account, essentially ‘pulling back’ the funds.

Point to Ponder: Are you using trusted payment gateways that offer protection against unauthorized reversals?

35. Identity Impersonation

This involves tenants using someone else’s identity—complete with stolen social security numbers and personal details—to pass credit checks and secure a rental.

Remember: Always ensure that the person you’re renting to is the person they claim to be. Consider meeting applicants in person or through video calls.

36. The Ghosting Act

After securing a property, some tenants might sublet it without permission, often at a rate higher than what they’re paying. You believe you’re renting to John, but in reality, it’s Jane living there, paying John a hefty sum.

Quick Tip: Your lease should have clear clauses about subletting and the consequences thereof.

37. The Elusive Middleman Fees

A tenant poses as an ‘agent’ or ‘middleman’ for another prospective renter and asks you for a finder’s fee. After receiving the payment, both the agent and the prospective tenant disappear.

Watch Out: Always be wary of unsolicited agents demanding commissions or fees.

38. The Rent Refund Racket

After moving in, a tenant might start making outrageous complaints about the property – think pests, mold, or non-functioning utilities. They demand hefty refunds or threaten legal action, even if their claims are baseless.

Protection Point: Ensure a thorough pre-rental inspection, possibly with the tenant present, and document everything.

39. Skewed Review Threats

In the era of online reputations, some tenants threaten to leave negative reviews on popular platforms unless they receive rent concessions or other benefits.

Counteraction: Maintain open communication and consider third-party mediators if disputes arise. Often, genuine positive reviews can counteract the negative ones.

40. Double Dealing with Deposits

A tenant might claim they made a bigger security deposit than they did, especially when moving out. They bank on the chance that you might not have kept accurate records.

Guardian Move: Always provide and retain receipts for all financial transactions. Digital tracking systems can be particularly helpful.

Every dark corner we shed light on makes the property management terrain safer and more navigable. As we illuminate these lesser-known or evolving scams, it reinforces the pivotal role of continual learning and adaptation in the ever-evolving rental industry.

Always remember: Knowledge isn’t just power; it’s protection.