A battle is brewing in the shadow of the Rocky Mountains that has nothing to do with skiing or hiking.

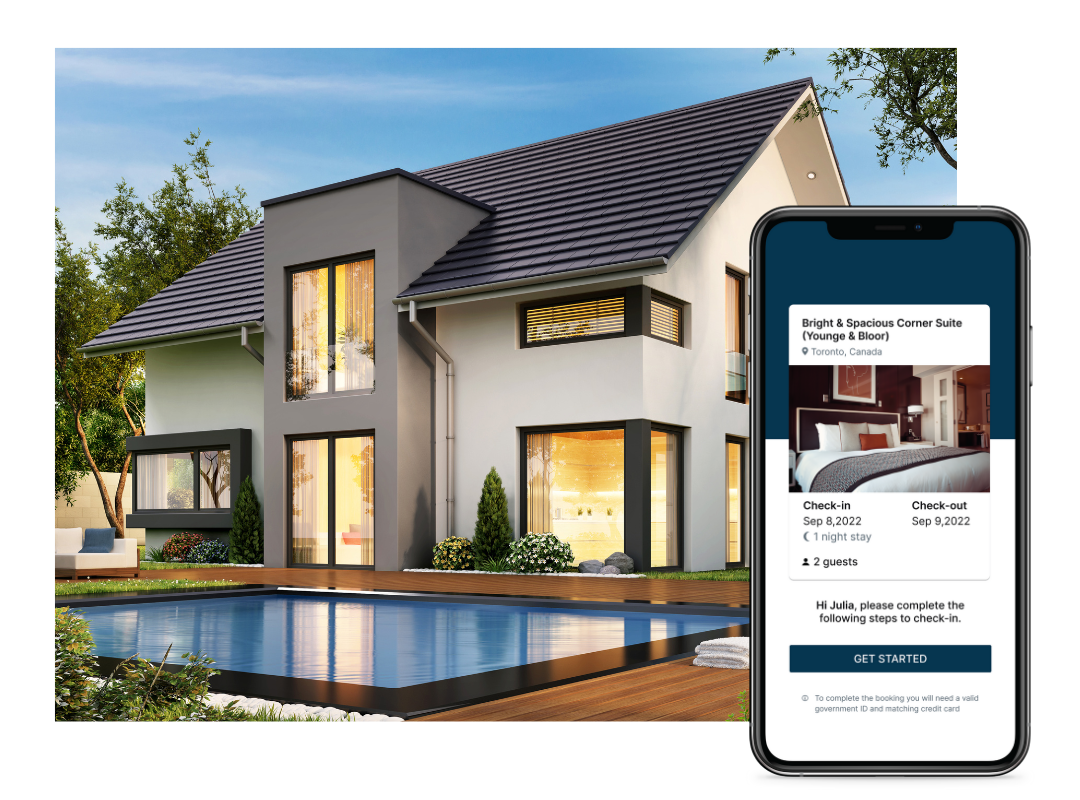

Denver, Colorado’s vibrant capital, finds itself at the epicenter of a nationwide debate over short-term rentals (STRs). As platforms like Airbnb and VRBO continue to reshape the hospitality landscape, city officials, property owners, and residents are grappling with a complex web of regulations that could make or break the Mile High City’s STR market.

Overview of Short-Term Rental Regulations in Denver

First things first, let’s define what we mean by short-term rentals.

In Denver, a short-term rental is typically any property that is rented out for fewer than 30 days at a time. This includes listings on popular platforms like Airbnb, VRBO, and others. The city has put these regulations in place to balance the booming short-term rental market with the needs of residents and neighborhoods.

Denver’s short-term rental laws weren’t just pulled out of thin air. They came about in response to the rapid growth of short-term rentals, which raised concerns about housing affordability and the character of residential neighborhoods. By implementing these regulations, the city aims to ensure that short-term rentals do not negatively impact the availability of long-term housing or the quality of life for permanent residents.

Understanding these regulations is crucial for property managers. Not only does it help avoid hefty fines and penalties, but it also ensures that properties are being managed responsibly and ethically. Denver’s regulations focus on several key areas: licensing, zoning, occupancy limits, safety standards, and tax obligations. Each of these aspects plays a vital role in maintaining a fair and balanced approach to short-term rentals in the city.

Licensing Requirements

Obtaining the proper license is one of the first steps in operating a short-term rental in Denver. The city requires all short-term rental hosts to have a license, and this applies to property managers overseeing such rentals. There are two main types of licenses: the Primary Residence License and the Accessory Dwelling Unit (ADU) License.

The Primary Residence License is for those who rent out part or all of their primary residence. This means that the property must be your main home, where you live most of the year. The ADU License, on the other hand, is for secondary units like basement apartments or backyard cottages, provided they are on the same lot as your primary residence.

Applying for a short-term rental license involves several steps. Property managers must complete an online application through Denver’s Department of Excise and Licenses. You’ll need to provide proof that the property is your primary residence, such as a driver’s license or utility bills. Additionally, you must submit a floor plan of the rental space and pay a licensing fee.

The renewal process is also crucial. Licenses must be renewed annually, and it’s important to keep track of expiration dates to avoid operating without a valid license. Failing to renew on time can lead to fines and other penalties, disrupting your rental operations.

One common pitfall in the licensing process is failing to demonstrate that the property is your primary residence. It’s essential to have all the necessary documentation in order to avoid delays or denials. Moreover, property managers should ensure that all information provided in the application is accurate and up-to-date, as discrepancies can lead to issues down the line.

Zoning and Property Usage

Zoning laws are another critical component of Denver’s short-term rental regulations. These laws determine where short-term rentals are permitted and help maintain the balance between residential and rental use in neighborhoods. In Denver, short-term rentals are generally allowed in residential zones, but there are some restrictions to be aware of.

The most important zoning rule for short-term rentals in Denver is the primary residence requirement. This means that the property must be your main home, where you live most of the year. This rule aims to prevent investors from buying up multiple properties solely for the purpose of renting them out short-term, which can drive up housing prices and reduce the availability of long-term rentals.

Additionally, there are restrictions on the types of properties that can be used as short-term rentals. For example, you cannot rent out a commercial property or a property in a zone that does not allow residential use. It’s crucial to check the zoning designation of your property before applying for a license to ensure it complies with Denver’s regulations.

Understanding the impact of zoning laws on your rental operations is essential. Property managers must be familiar with the specific zoning requirements for their properties to avoid violations. This includes knowing whether your property is in a permitted zone and adhering to any additional restrictions that may apply.

Navigating Denver’s zoning laws can be complex, but it’s a necessary part of managing short-term rentals effectively. Property managers should stay informed about any changes to zoning regulations and be proactive in ensuring their properties remain compliant. This not only helps avoid legal issues but also contributes to maintaining good relationships with neighbors and the community.

Compliance and Enforcement

Staying compliant with Denver’s short-term rental regulations is essential for property managers. The city takes these rules seriously and has set up systems to ensure that all short-term rentals operate within the law. Failing to comply can lead to hefty fines, penalties, and even the revocation of your rental license.

Denver has a dedicated team that conducts compliance checks. These checks can be random or triggered by complaints from neighbors or other stakeholders. As a property manager, it’s your responsibility to ensure that all aspects of the property and its operation meet the city’s requirements. This means regularly reviewing the regulations and making sure your rental property is up to standard.

One of the most common issues property managers face is the accuracy of the information provided in their license application. Always keep your documentation current and truthful. If there are any changes to the property or your contact information, update the relevant authorities immediately. Another key aspect of compliance is making sure that your property remains your primary residence if you hold a Primary Residence License. The city has ways of verifying this, and discrepancies can lead to serious consequences.

Denver has set clear penalties for non-compliance. These can range from fines to more severe actions like the suspension or revocation of your rental license. Fines can add up quickly, especially if multiple violations are found. For example, operating without a valid license can result in fines of up to $999 per incident. Repeat offenders face even stricter penalties, which can severely impact your rental business.

To avoid these pitfalls, it’s a good idea to conduct your own regular compliance checks. Keep detailed records of your operations, including guest logs, maintenance schedules, and safety inspections. This documentation can be invaluable if there’s ever a question about your compliance status. Regularly reviewing the city’s regulations and staying informed about any changes will help you stay ahead of potential issues.

Occupancy and Safety Standards

Denver has specific rules regarding how many people can stay in a short-term rental property. These occupancy limits are designed to ensure the safety and comfort of guests and to minimize disruptions to the neighborhood. Typically, the maximum occupancy is determined by the number of bedrooms and the size of the property. It’s important for property managers to be familiar with these limits and to enforce them strictly.

In addition to occupancy limits, there are several safety standards that all short-term rentals must meet. These include having working smoke detectors and carbon monoxide detectors in key areas of the property. Fire extinguishers must be accessible, and the property should have clear, unobstructed exits in case of an emergency. These measures are not just about compliance—they’re about ensuring the safety of your guests.

The city also requires that short-term rental properties comply with local building and fire codes. This means making sure that the property is structurally sound and that all electrical and plumbing systems are up to code. Regular safety inspections are a good practice to ensure that everything is in order. Preparing for these inspections involves checking all safety equipment, ensuring that exits are clearly marked, and keeping the property in good repair.

One area that often gets overlooked is the requirement for emergency contact information. Property managers must provide guests with clear instructions on what to do in case of an emergency, including contact numbers for local emergency services and a local contact person who can assist if needed. This information should be readily accessible, such as in a welcome binder or posted in a visible location within the property.

Taxation and Fees

Operating a short-term rental in Denver comes with specific tax obligations that property managers must be aware of. These taxes help fund city services and infrastructure that support the tourism industry. Understanding and fulfilling these obligations is a critical part of managing a short-term rental property.

First and foremost, short-term rentals in Denver are subject to the Lodger’s Tax. This tax is levied on the rental income generated from short-term stays. As a property manager, you’re responsible for collecting this tax from your guests and remitting it to the city. The current rate for the Lodger’s Tax is 10.75%, which includes Denver’s standard sales tax as well. It’s crucial to incorporate this tax into your pricing strategy so that you don’t end up covering it out of your own pocket.

In addition to the Lodger’s Tax, there may be other applicable fees, such as business taxes or licensing fees. Keeping track of these fees and ensuring they are paid on time is essential. Failure to do so can result in penalties and interest charges, which can add up quickly.

The process of reporting and paying these taxes involves regular filings with the city’s finance department. Typically, you’ll need to file monthly or quarterly returns, detailing the income generated from your short-term rental and the taxes collected. It’s important to maintain accurate and detailed records of all transactions to ensure your filings are correct. Many property managers find it helpful to use accounting software or hire a professional accountant to manage this aspect of their business.

One best practice is to set aside the tax amount from each booking in a separate account. This way, you’re not caught off guard when it’s time to remit the taxes. Keeping thorough records of your bookings, payments, and tax remittances will make the process smoother and help you avoid any discrepancies during audits.

Neighbor and Community Relations

Maintaining good relations with neighbors and the community is crucial for any property manager. When operating a short-term rental, it’s essential to be mindful of how it impacts the neighborhood. Start by introducing yourself to neighbors and providing them with your contact information. Let them know they can reach out if there are any issues related to your rental property.

Noise and nuisance regulations are particularly important. Denver has strict rules to ensure that short-term rentals do not disturb the peace of residential neighborhoods. Make sure your guests are aware of quiet hours and local noise ordinances. Including this information in your house rules and reminding guests at check-in can help prevent problems.

Trash and recycling are other areas where compliance is key. Denver requires short-term rental hosts to provide adequate trash and recycling facilities. Ensure that bins are clearly labeled and that guests know when and where to dispose of their waste. Regularly check the property to ensure that trash does not accumulate, which can attract pests and cause complaints from neighbors.

Best Practices for Property Managers

Effective short-term rental management goes beyond just complying with regulations. It involves creating a positive experience for guests while ensuring the property operates smoothly. One of the best ways to achieve this is by screening and vetting guests. Platforms like Autohost can help you automate the screening process, ensuring that only responsible guests are approved.

Leveraging technology can also make compliance easier. Property management software can help you keep track of bookings, manage communications, and ensure that all regulatory requirements are met. Tools like noise monitors, smart locks, and security cameras can enhance safety and help maintain order at your property.

Maximizing rental income while staying compliant involves strategic pricing and marketing. Monitor local market trends to adjust your rates accordingly and make sure your listing is appealing and accurate. High-quality photos, detailed descriptions, and positive reviews can attract more guests and justify premium pricing.

Updates and Changes to Regulations

Staying informed about updates and changes to Denver’s short-term rental regulations is crucial for property managers. Regulations can change, and staying ahead of these changes ensures that your property remains compliant. Regularly check the city’s official website and subscribe to newsletters from industry associations to get the latest updates.

Continuing education is also important. Attend workshops, webinars, and industry conferences to stay informed about best practices and regulatory changes. Networking with other property managers can provide valuable insights and support.

Being proactive about regulatory changes means you won’t be caught off guard. Implement changes promptly and ensure your staff is aware of any new requirements. Keeping an eye on the regulatory landscape helps you adapt quickly and maintain compliance.