If you’re running an Airbnb, you know the devil is in the details. Guests book properties that feel well-thought-out and cater to their specific needs. Amenities aren’t just about providing comfort—they’re tools to set your listing apart. With competition getting fiercer, hosts who master the art of offering value through their amenities often land better reviews, higher occupancy rates, and a steady stream of repeat guests. Below are 10 must-have amenities that go beyond the basics to truly elevate your listing.

1. A Fully-Equipped Kitchen

Today’s travelers are looking for more than just a microwave and a mini-fridge. A full kitchen stocked with high-quality essentials can be a major draw, especially for families, remote workers, or longer-term stays. Think beyond standard utensils and cookware. Adding a spice rack, olive oil, aluminum foil, and even a good chef’s knife can make guests feel like they’re in their own home.

Take it a step further by providing appliances like a blender, rice cooker, or air fryer—items that guests don’t expect but deeply appreciate when available. To impress, leave a guide with quick recipes or suggestions for local farmers’ markets where they can pick up fresh ingredients.

2. Luxury Bedding and Blackout Curtains

The bedroom is where your guests will spend most of their time, yet it’s often overlooked. Invest in top-tier mattresses, high-thread-count sheets, and plenty of pillows in varying firmness levels. Memory foam mattress toppers can also help elevate a standard bed to luxury.

Blackout curtains are non-negotiable for light-sensitive sleepers, and sound machines or white noise apps pre-loaded on bedside tablets can help create a restful environment. Small details, like a charging station within arm’s reach of the bed, show that you’ve thought through your guests’ experience.

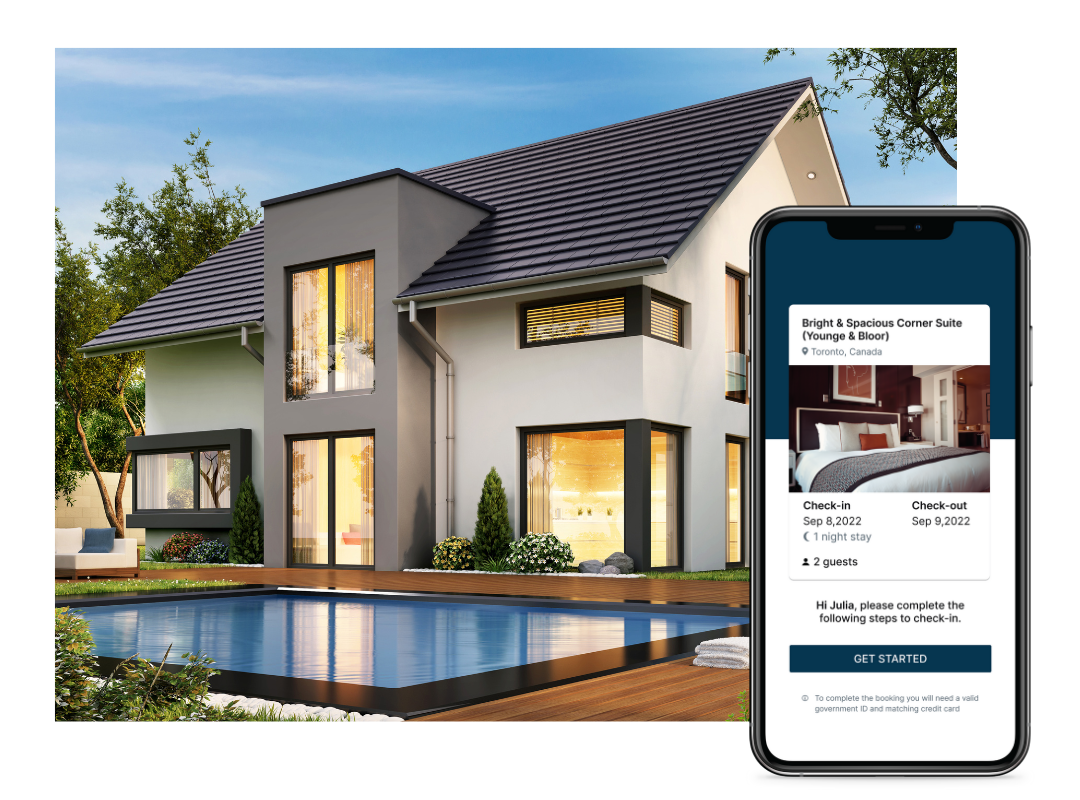

3. Smart Tech Integration

Wi-Fi alone isn’t enough anymore—guests want convenience and control. Smart locks, app-controlled thermostats, and voice assistants like Alexa can streamline their stay. Guests appreciate tech that makes their life easier, whether it’s adjusting the temperature without getting out of bed or receiving personalized recommendations through a smart speaker.

Just be mindful of privacy concerns. Provide clear instructions on how devices work and reassure guests that they can disable features if desired. Offering a high-speed internet connection with a mesh network for larger properties can also prevent connectivity issues.

4. Work-Friendly Spaces

With remote work becoming the norm for many travelers, having a dedicated workspace can set your property apart. A simple desk, ergonomic chair, and desk lamp can transform a corner of the room into a productive hub. Add outlets or USB ports near the desk for easy device charging.

If you’re targeting long-term guests, take it further with dual monitors, noise-canceling headphones, and adjustable sit-stand desks. A strong, stable Wi-Fi connection is crucial, and make sure to label it with both speed information and login credentials placed in multiple easy-to-find locations.

5. High-Quality Toiletries

Cheap, generic toiletries are a quick way to signal that your property cuts corners. Instead, invest in high-quality, eco-friendly brands that feel indulgent. Brands like Aesop, L’Occitane, or a local artisan soap maker not only elevate your listing but can also be a conversation starter in reviews.

Refillable dispensers with shampoo, conditioner, and body wash are better for the environment and make refilling easier between stays. Throw in extras like makeup remover wipes, a sewing kit, or even a high-end hairdryer with multiple heat settings to win major points.

6. Outdoor Spaces with Purpose

A patio, balcony, or backyard is nice, but it’s even better when it’s thoughtfully designed for relaxation and entertainment. Consider adding outdoor furniture that’s both comfortable and stylish, along with weather-appropriate items like a fire pit, patio heaters, or an umbrella for shade.

If your property is in a colder climate, heated blankets for outdoor use can be a game-changer. And if you’re in a warmer area, an outdoor fan or misters can help guests enjoy the space year-round. An herb garden or small grilling station adds a personal touch and encourages guests to make the most of the outdoors.

7. Laundry Facilities

For longer stays, laundry access is more than a convenience—it’s a necessity. A washer and dryer, complete with detergent, dryer sheets, and even a drying rack for delicate items, can go a long way in winning over guests.

If space is limited, a compact washer/dryer combo or a portable drying rack can still be a huge benefit. Take it a step further by offering eco-friendly detergents or pre-measured pods, and include instructions for any tricky-to-use machines.

8. Kid- and Pet-Friendly Extras

Families with young kids or pets are often underserved by Airbnb hosts. By catering to these groups, you open your property to a wider audience. Provide items like high chairs, pack-and-plays, or baby gates for families with children.

Pet owners will appreciate water and food bowls, waste bags, or even a small outdoor pet area. Clear rules about pet fees or restrictions upfront can prevent misunderstandings, and offering a pet-friendly space that doesn’t feel like an afterthought will earn loyalty from this niche group of travelers.

9. Welcome Kits and Personalized Touches

A well-thought-out welcome kit can set the tone for your guests’ stay. Include items like a handwritten note, local snacks, or a map of nearby attractions. Small gestures, like providing coffee pods for the coffee maker or fresh bread from a local bakery, can make a stay memorable.

For an even bigger impact, tailor the kit to the guest. If someone’s staying for a birthday, leave a small cake or a bottle of wine. If it’s a family vacation, include toys or coloring books for the kids. This level of personalization shows that you value your guests’ experience and are willing to go the extra mile.

10. Safety Features and Accessibility

Safety and accessibility are often overlooked but can make or break a guest’s experience. Install motion-sensor outdoor lights, carbon monoxide detectors, and a first-aid kit that’s easy to find. If your property is in an area prone to storms or outages, provide flashlights, candles, and instructions for emergencies.

For accessibility, consider features like ramps, grab bars in bathrooms, or wider doorways. Even small adjustments, like a shower chair or a non-slip mat, can make a world of difference for guests with mobility challenges. Mentioning these in your listing will appeal to a broader audience and highlight your commitment to inclusivity.

Guests notice the details, whether it’s the quality of the towels or the effort you’ve put into creating a functional outdoor space. By offering these thoughtful amenities, you’re not just meeting expectations—you’re surpassing them. And in an industry where reviews reign supreme, those small touches are what lead to glowing recommendations and repeat bookings.