Understanding zoning rules is a crucial part of managing short-term rentals. Whether you’re renting out a vacation home or a city apartment, understanding these regulations can save you from potential legal issues and help you run a smooth operation. This guide will walk you through everything you need to know about zoning rules for short-term rentals, from understanding the basics to researching and complying with local laws.

Zoning Rules

Zoning rules are local regulations that dictate how properties in specific areas can be used. They are designed to ensure that land use is organized in a way that promotes public health, safety, and general welfare. For example, zoning laws can prevent a noisy factory from being built in a quiet residential neighborhood.

These rules are critical for maintaining the character and functionality of different parts of a city or town. In the context of short-term rentals, zoning rules determine where you can legally operate your rental property. They can also set limits on things like the number of guests you can host, the length of stays, and whether you need a special permit or license.

Common Types of Zoning

There are several types of zoning that you should be aware of. The most common include residential, commercial, and mixed-use zones.

Residential Zoning:

This is where most short-term rentals are located. Residential zoning can include single-family homes, multi-family units, and apartments. Each type has its own set of rules about what you can and cannot do.

Commercial Zoning:

If you’re thinking about renting out a property in a commercial zone, such as a loft in a downtown area, be prepared for different regulations. Commercial zones often have more lenient rules regarding rentals, but they might come with other requirements, like business licenses or specific safety standards.

Mixed-Use Zoning:

These areas combine residential and commercial uses. Mixed-use zoning is becoming more popular in urban areas and can offer more flexibility for short-term rentals. However, the rules can be a bit more complex, as they need to balance the interests of both residents and businesses.

Researching Zoning Laws

Local Government Resources

The first step in researching zoning laws is to check with your local government. Most cities and towns have a zoning office or department that handles these regulations. You can often find information on their website, including zoning maps, ordinances, and contact information for zoning officials.

Don’t hesitate to reach out to these officials if you have questions. They can provide valuable insights and clarify any confusing aspects of the regulations. It’s always better to ask upfront than to make assumptions and risk non-compliance.

Community Planning Departments

Another great resource is your community planning department. These departments are responsible for the broader aspects of urban development and land use. They can offer a more comprehensive view of how zoning rules fit into the overall planning and development of your area.

Engaging with community planners can give you a deeper understanding of the zoning landscape. They can inform you about any upcoming changes to the regulations that might affect your rental business. Plus, they often have public meetings where you can hear about and participate in discussions related to zoning and land use.

Online Tools and Databases

In addition to local government resources, there are various online tools and databases that can help you research zoning laws. Websites like Municode or your city’s official website often have searchable databases of zoning ordinances. These tools allow you to look up specific properties and see what zoning rules apply.

Online mapping tools are also incredibly useful. They can provide a visual representation of different zoning areas, making it easier to see where your property falls. Some platforms even offer interactive features that let you explore zoning regulations in detail. These tools can save you a lot of time and make the research process much more manageable.

Compliance with Zoning Regulations

Permit and Licensing Requirements

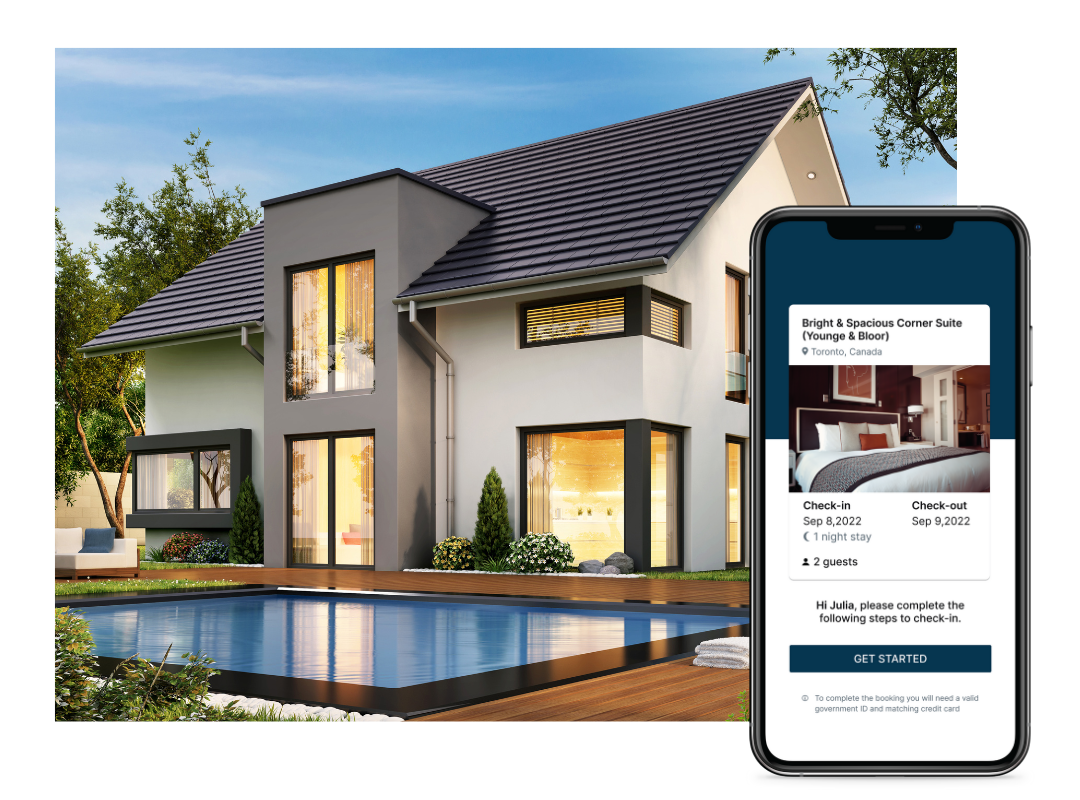

Once you’ve done your homework on local zoning laws, the next step is making sure you have all the necessary permits and licenses to operate your short-term rental. Many areas require you to get a specific permit for short-term rentals, separate from any general business licenses you might need.

The process for obtaining these permits can vary. Typically, you’ll need to fill out an application form, provide some documentation about your property, and pay a fee. Documentation might include proof of ownership, floor plans, or safety inspections. It’s essential to follow this process carefully because operating without the proper permits can lead to fines or even the shutdown of your rental.

Some areas also have limits on the number of short-term rental permits they issue, so it’s a good idea to apply as early as possible. Keep in mind that your permit might need to be renewed annually, so mark your calendar to avoid any lapses.

Operational Restrictions

Zoning regulations often come with a set of operational restrictions aimed at maintaining the neighborhood’s character and livability. One common restriction is the limit on the number of guests you can host at one time. This is usually tied to the size of your property and is meant to prevent overcrowding.

Noise ordinances are another key area. These rules are in place to ensure that short-term rentals don’t become a nuisance to neighbors. As a host, you should inform your guests about local noise restrictions, especially during nighttime hours. Consider implementing house rules that help maintain a peaceful environment.

Parking is also frequently regulated. Some areas require that you provide a certain number of off-street parking spaces for your guests. If your property doesn’t have adequate parking, you might need to make arrangements with nearby facilities or limit the number of vehicles your guests can bring.

Homeowners Associations (HOAs)

If your property is part of a homeowners association, you’ll need to navigate an additional layer of regulations. HOAs often have their own rules regarding short-term rentals, which can be stricter than local zoning laws. These rules can cover everything from rental duration limits to guest behavior and property maintenance standards.

It’s crucial to review your HOA’s covenants, conditions, and restrictions (CC&Rs) thoroughly. Some HOAs outright prohibit short-term rentals, while others may allow them with specific conditions. Violating HOA rules can result in hefty fines and legal disputes, so ensure you have a clear understanding of what’s allowed.

If there’s a conflict between HOA rules and local zoning laws, HOA rules usually take precedence. However, it’s wise to consult with a legal professional if you’re unsure. They can help you interpret the rules and find a compliant way to operate your rental.

Consequences of Non-Compliance

Legal Penalties

Ignoring zoning regulations can lead to significant legal troubles. The penalties for non-compliance vary by location but can include hefty fines, legal action, and forced closure of your rental. In some cases, repeated violations can result in criminal charges.

For example, if you operate a short-term rental without the necessary permits, local authorities can issue fines that accumulate daily until you comply. Legal action can also involve court appearances and additional costs for legal representation. It’s much more economical to ensure you’re compliant from the start.

Reputational Risks

Beyond legal penalties, non-compliance can severely damage your reputation. Bad reviews and negative word-of-mouth can spread quickly, especially in the age of social media. Guests who encounter problems due to your failure to comply with local laws are likely to share their experiences online, potentially deterring future guests.

A damaged reputation can lead to a significant drop in bookings, which affects your income. It’s important to build trust with your guests by being transparent about your adherence to local regulations. This transparency can enhance your reputation and encourage repeat bookings and positive reviews.

Adapting to Changing Zoning Laws

Monitoring Changes

Zoning laws aren’t static; they can change in response to new housing trends, political pressures, or community feedback. Staying informed about these changes is crucial for maintaining compliance and avoiding surprises. Regularly check your local government’s website or subscribe to newsletters that provide updates on zoning regulations.

Attending local council meetings or zoning board hearings can also keep you in the loop. These meetings are often open to the public and provide a forum for discussing proposed changes to zoning laws. Engaging in these discussions can give you a heads-up about potential changes and allow you to voice your concerns or support.

Advocacy and Participation

Staying compliant with zoning laws isn’t just about following the rules; it’s also about engaging with the community. Participating in local government meetings and zoning board hearings can make a significant difference. By getting involved, you can advocate for regulations that are fair and beneficial to short-term rental operators like yourself. When community members see that you are invested in the neighborhood, they are more likely to support your business.

Advocacy doesn’t have to be intimidating. Start by attending a few meetings to get a sense of the discussions. When you’re ready, share your perspective on how short-term rentals can positively impact the community. Bringing in data or testimonials from satisfied guests can help bolster your case.

Adjusting Business Strategies

Sometimes, zoning law changes might require you to tweak your business model. For example, if new regulations limit the number of rental nights per year, you might need to adjust your pricing strategy or target different types of guests. Flexibility is key.

Consider diversifying your portfolio. If one property faces stringent new rules, having another rental in a more lenient area can provide a buffer. Alternatively, explore different types of rentals, such as mid-term stays for traveling professionals, which might not be subject to the same restrictions as short-term rentals.

Best Practices for Zoning Compliance

Documentation and Record Keeping

Keeping thorough records is a cornerstone of zoning compliance. Maintain a file with all your permits, licenses, and correspondence with local authorities. This way, if there’s ever a question about your compliance, you can quickly provide proof.

Documentation also includes keeping records of guest stays, including how you adhere to guest limits, noise ordinances, and other operational restrictions. A well-organized system can save you time and trouble if you need to respond to a complaint or a surprise inspection.

Professional Assistance

Sometimes, the intricacies of zoning laws can be overwhelming. That’s where professionals come in. A lawyer specializing in zoning laws or a zoning consultant can offer invaluable advice. They can help interpret complicated regulations, assist with permit applications, and represent you in disputes. While this might seem like an added expense, it can be a worthwhile investment to avoid costly mistakes.

Community Engagement

Building a good relationship with your neighbors can ease many zoning challenges. Friendly interactions can prevent complaints and foster a supportive environment. Make it a habit to introduce yourself to neighbors and share your contact information in case any issues arise. Hosting occasional community events or meetings can also help demonstrate your commitment to being a good neighbor.

Encouraging guests to respect the neighborhood is equally important. Provide clear house rules and local guidelines to ensure they understand what is expected during their stay.