Being an Airbnb host in today’s competitive market means going beyond the basics. Guests expect clean sheets, working appliances, and Wi-Fi—it’s the little extras that truly make your property stand out. To win glowing reviews and earn repeat bookings, you’ll need to create an experience that feels effortless, memorable, and guest-centric. The good news? You don’t need a huge budget or a full renovation. Strategic, thoughtful upgrades can turn your property into a favorite choice for travelers.

Let’s break down how to elevate your rental with upgrades that guests will love.

Focus on Comfort: The Backbone of Great Stays

Guests often gauge their stay based on how comfortable they felt. It’s not just about providing a bed; it’s about curating an environment that promotes relaxation. Start by upgrading the mattress—skip the standard option and invest in one with medium-firm support and a plush top layer. Consider pairing it with hotel-quality linens that feel luxurious without being overly expensive.

Small additions, like weighted blankets or extra throw pillows, can cater to various guest preferences. And don’t overlook temperature control; smart thermostats and portable fans or heaters in individual rooms allow guests to tailor the space to their liking.

Smart Home Features That Feel Seamless

Adding smart technology can instantly upgrade your property’s appeal. But remember, not all gadgets are created equal. Stick with intuitive tools that improve convenience rather than overcomplicate things.

Smart Locks:

No one enjoys fumbling with keys after a long day of travel. Keyless entry systems make check-in seamless while adding a layer of security.

Voice Assistants:

Devices like Alexa or Google Nest let guests control lights, music, or ask for local recommendations.

Smart TVs:

Pre-load streaming apps and provide easy instructions for use. Guests often appreciate the ability to log into their accounts for a night of Netflix.

Keep all devices updated and offer simple guides to help less tech-savvy guests navigate these additions.

Design That Feels Thoughtful, Not Trendy

A trendy design might catch attention in the short term, but timeless and functional decor makes a lasting impression. Neutral tones, clean lines, and layered textures work for nearly all guest demographics. Consider focusing on practical upgrades like blackout curtains, which enhance privacy and help travelers sleep better.

A subtle design upgrade like swapping cheap plastic chairs for ergonomic seating or adding area rugs to hard floors can instantly make a space feel warmer and more inviting.

Pay close attention to lighting. Replace outdated fixtures with dimmable, warm-toned options. This allows guests to adjust the mood of the room, from bright daylight to soft evening lighting.

Bathrooms Guests Actually Want to Use

Bathrooms are often overlooked but are among the most crucial spaces in a rental. A spa-like atmosphere doesn’t require a full remodel—just a few upgrades:

Showerheads:

Replace old ones with rain or handheld options.

Towels:

Offer oversized, fluffy towels, and keep a few extras stocked.

Toiletries:

Go beyond the basics. Travel-sized bottles are fine, but investing in dispensers filled with quality, eco-friendly products signals care.

Add a makeup mirror, ample counter space, and perhaps a small laundry basket for convenience. These details resonate with guests and make them feel pampered.

Kitchen Upgrades: A Haven for Longer Stays

Even if your guests don’t plan to cook, a well-equipped kitchen adds significant value to your rental. Begin with the essentials: a sharp knife set, non-stick cookware, and matching dinnerware. Avoid mismatched items, as they give off an unpolished vibe.

For longer stays, adding appliances like a slow cooker, air fryer, or blender can make a difference. Stocking the pantry with basics like coffee, tea, sugar, salt, and pepper is another low-cost way to show thoughtfulness.

If space allows, a bar cart or wine fridge offers a touch of sophistication, especially for couples or groups looking to celebrate.

Outdoor Areas That Encourage Relaxation

If your property has outdoor space, consider how guests might use it. You don’t need a sprawling backyard—just a functional and inviting setup. Comfortable seating, a clean patio, and even a portable fire pit create an inviting atmosphere for guests.

String lights are a simple yet effective upgrade. They create a warm ambiance and make the space feel magical at night. If the budget allows, consider adding a small grill or outdoor dining set for families who might want to cook outside.

Make Technology Work for You

Beyond smart devices, consider what digital upgrades can improve the guest experience. Reliable, high-speed Wi-Fi is non-negotiable, especially for digital nomads. But there are additional ways to impress your guests:

Provide a dedicated workspace with ergonomic furniture and power outlets.

Offer a charging station with universal cables for phones, tablets, and laptops.

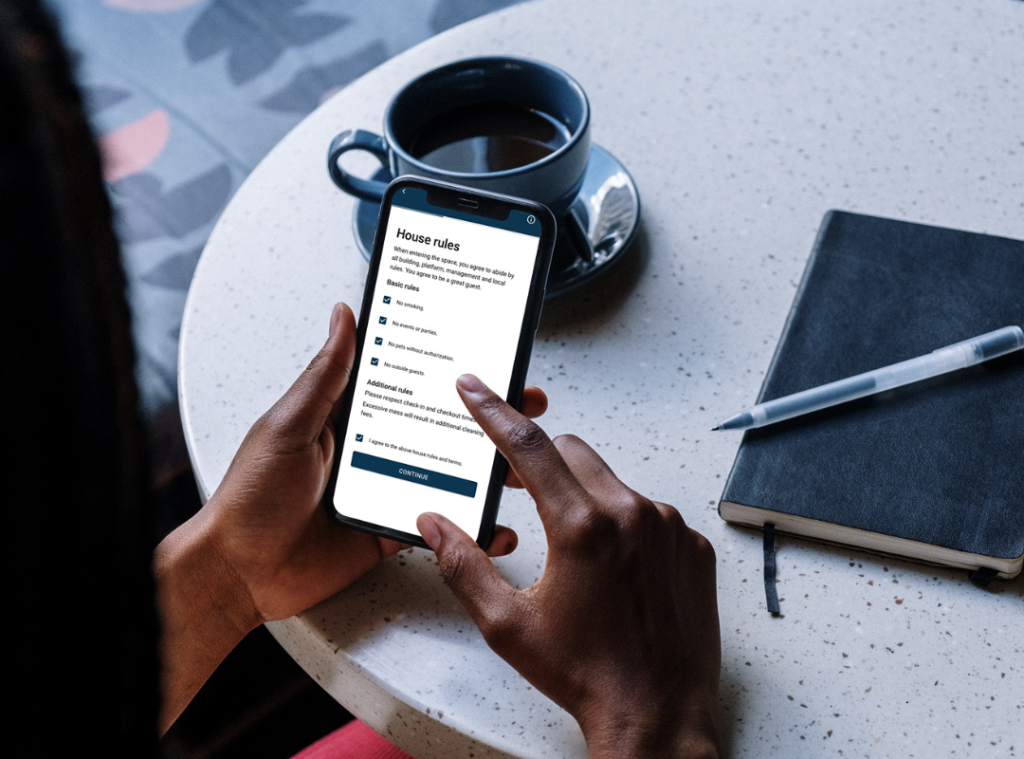

Set up a QR code or digital manual with house rules, local recommendations, and troubleshooting guides for appliances.

These upgrades cater to modern travelers and make your property a practical choice for work and leisure.

Build Personality Into the Experience

Cookie-cutter rentals can feel impersonal, leaving no reason for a guest to book again. Adding unique touches can set your property apart. Think of ways to showcase local culture or reflect the personality of your home.

Consider stocking books by local authors or adding wall art that reflects the area’s heritage. Leaving a handwritten note or a welcome basket with regional snacks can make the stay feel personal and memorable.

Personal touches don’t have to be expensive—they just need to show you care.

Pet-Friendly Perks

If your rental is pet-friendly, show it through thoughtful upgrades. Add washable slipcovers to furniture, place dog bowls in the kitchen, and keep lint rollers handy. Outdoor spaces can include a small dog run or waste bag dispenser for convenience.

These small considerations show that you’ve thought through every aspect of their stay, earning loyalty from pet owners.

Elevate Safety and Security

Guests prioritize safety, and properties that take this seriously tend to score higher reviews. Beyond standard smoke detectors, consider adding carbon monoxide detectors, fire extinguishers, and first aid kits.

Take safety a step further by securing windows with childproof locks or installing motion sensor lights around entryways. If you’re investing in a pool or hot tub, clear signage about safety guidelines is essential.

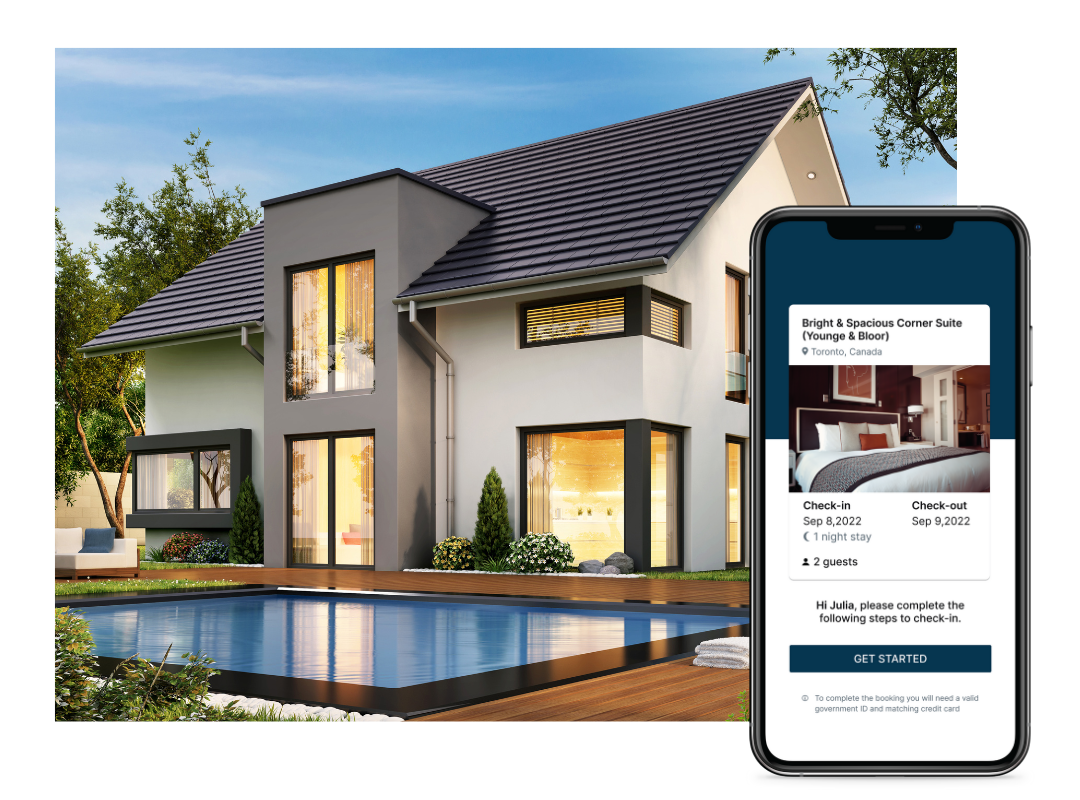

Additionally, implementing a guest screening system, like Autohost, helps ensure safety for both you and your guests. Knowing that you have a process in place to verify identities and monitor bookings builds trust.

Streamlined Cleaning and Maintenance

While not as visible to guests, upgrading cleaning processes pays off. Using high-quality vacuums, stain-resistant furniture, and washable rugs simplifies upkeep and keeps the property looking fresh.

Hosts can also provide cleaning supplies for guests who want to tidy up during their stay. Small touches, like leaving dishwashing pods or laundry detergent, go a long way in showing thoughtfulness.

Regular maintenance checks to replace light bulbs, tighten screws, or touch up paint ensure the property stays in top condition for every guest.

Seasonal Touches Guests Notice

Adapting your property for the season can elevate the guest experience. In summer, provide beach towels, sunscreen, or a cooler. For winter stays, offer cozy throws, slippers, and maybe even a small hot chocolate station.

These rotating additions make your listing feel alive and in tune with your guest’s needs. Plus, they can lead to unique photos that help market your property on platforms like Airbnb.

Making your Airbnb a guest favorite doesn’t require major renovations or a massive budget. The goal is to provide a seamless experience where every detail feels intentional. By focusing on comfort, convenience, and personality, you can create a space that guests love—and one they’ll want to return to again and again.

The upgrades you choose don’t just benefit your guests—they protect your investment and strengthen your reputation as a top-tier host. The payoff? Better reviews, higher occupancy rates, and a steady stream of bookings from delighted travelers.