In the world of property management, the importance of tenant referencing cannot be overstated. It serves as the backbone of a successful rental operation, helping managers secure reliable and trustworthy tenants. This guide aims to walk you through the ins and outs of tenant referencing, providing you with a comprehensive toolkit to enhance your screening process. From understanding the basics to diving deep into the checks and necessary documents, we’ll cover everything you need to manage your properties more effectively.

Understanding Tenant Referencing

Tenant referencing is essentially a background check for potential renters. Its primary purpose is to gauge a tenant’s reliability and likelihood to fulfil the terms of their lease agreement. Think of it as a preventive measure—by thoroughly vetting applicants, you significantly reduce the risks associated with non-payment, property damage, and other tenant issues that can negatively impact your business.

The process involves several key elements: verifying the tenant’s identity, checking their financial stability, and assessing their rental history. These steps ensure that the tenant can afford the rent and has a track record of responsible tenancy. More importantly, it helps create a safe and stable community for all residents, which is a huge plus in maintaining the attractiveness of your property.

Effective tenant referencing is not just about filtering out potentially problematic renters; it’s also about finding a good match between the property and the tenant. This fit goes beyond the financials—it’s about ensuring that the tenant’s lifestyle and habits are compatible with the community and property rules. For instance, a busy professional might prefer a quiet apartment complex over a family-oriented neighborhood. Understanding these nuances can lead to longer tenancies and fewer turnovers.

The Tenant Referencing Process

Embarking on the tenant referencing journey starts with a clear and structured process. First, inform potential tenants that a thorough background check is a mandatory part of the application process. Transparency here is key—it sets the right expectations and demonstrates your professionalism.

The process typically begins with the collection of basic personal information through a rental application form. This form should ask for the tenant’s full name, date of birth, current and previous addresses, employer details, and references from previous landlords. It’s crucial to get consent from the applicant to run these checks; not only is this a legal requirement, but it also fosters a sense of trust and openness.

Next, proceed with verifying the information provided. Start with a credit check to assess financial reliability. A credit report will reveal a lot about an applicant’s financial history, including past bankruptcies, late payments, and overall debt levels. However, remember that a lower credit score doesn’t automatically disqualify a potential tenant—it could be due to many reasons, such as medical bills or student loans. It’s important to consider the whole picture and engage in a dialogue with the applicant to understand their financial status better.

Employment verification is another critical step. This isn’t just about confirming that the tenant has a job; it’s about ensuring their income is stable and sufficient to cover the rent. A simple phone call to their employer can verify the details provided, such as length of employment, position held, and salary. Some property managers also ask for recent pay stubs or bank statements for further proof of income.

Previous landlord references are equally vital. Contacting past landlords can provide insights into the tenant’s behavior, such as their punctuality in paying rent, how they maintained the property, and whether there were any complaints from neighbors. This first hand feedback is invaluable and often tells you more than any document can.

While the process might seem extensive, each step is designed to build a complete profile of the applicant. Skipping any of these can lead to future complications. It’s like putting together a puzzle—each piece is crucial to seeing the full picture. By being thorough in your approach, you ensure that you are making informed decisions that will benefit your property management in the long run.

Tenant Referencing Check

Once the initial steps of gathering and verifying tenant information are completed, the actual tenant referencing check can commence. This is where you dive deeper into the specifics of an applicant’s background to make sure they’re a safe and reliable choice for your property. The referencing check typically includes a more detailed look at credit history, criminal records, eviction history, and sometimes even a check on the social media profiles to gauge lifestyle and behavior.

A thorough credit check is a cornerstone of this phase. It goes beyond just confirming the tenant can pay, looking at their financial habits and stability over time. Are there frequent late payments? Is there a pattern of overextending credit? These insights are crucial because they often predict how a tenant will handle rent responsibilities.

Criminal background checks are equally important. While it’s necessary to comply with fair housing laws and not discriminate based on past offences, certain types of criminal history may be a legitimate disqualification, especially if they pose a safety risk to the property and other tenants. For instance, a history of violent crime or drug distribution could be considered valid reasons to deny an application.

Eviction records can tell you a lot about how a tenant interacts with property rules and lease agreements. An eviction might not always disqualify a potential tenant—it’s important to understand the context and reasons behind it, such as financial hardships or disputes over property conditions. This part of the check needs to be handled sensitively and fairly, balancing past issues with potential future behavior.

Preparing a Tenant Referencing Letter

The tenant referencing letter is a crucial document in the tenant screening process. It serves as a formal summary of the information gathered during the referencing checks and communicates the decision regarding the rental application. Preparing an effective tenant referencing letter requires clarity, thoroughness, and professionalism.

Firstly, start with the basics: address the letter properly to the prospective tenant and include the date and your contact information. State clearly the purpose of the letter—whether it’s to inform them of acceptance, denial (with reasons), or conditional acceptance based on certain stipulations, such as requiring a co-signer.

In the case of a denial, it’s important to be as clear and specific as possible, citing the exact reasons based on the referencing checks. For example, if the denial is due to poor credit history, specify this and consider including instructions on how they might view their own credit report. This not only helps maintain transparency but also provides the applicant with an opportunity to rectify issues before applying elsewhere.

For accepted applications, outline any next steps, such as security deposit details, lease signing schedules, and any other preliminary arrangements. Ensuring these elements are explicitly stated will help avoid any confusion and streamline the move-in process.

Legal Considerations in Tenant Referencing

Navigating the legal landscape of tenant referencing is critical. Understanding and adhering to applicable laws ensure that your screening process is fair and does not inadvertently discriminate against any potential tenants. Key legislation includes the Fair Housing Act, which prohibits discrimination based on race, color, national origin, religion, sex, familial status, or disability. It’s vital to ensure that your tenant screening process and the criteria you use are consistent and applied equally to all applicants to avoid any biases or legal repercussions.

Additionally, it’s important to be familiar with laws regarding consumer reports, especially under the Fair Credit Reporting Act (FCRA). This law governs how consumer credit information can be used in tenant screening. Property managers must obtain written consent from applicants to perform credit checks and must provide adverse action notices if information in these reports is used against them in the application process.

Privacy issues also play a significant role in tenant referencing. Ensure that all personal information collected is handled and stored securely to prevent unauthorized access or breaches. Applicants have the right to know how their information is being used, and keeping them informed builds trust and respect.

Handling legal considerations with care not only protects you and your property management business legally but also positions your operations as ethical and professional, enhancing your reputation among potential tenants.

Common Challenges in Tenant Referencing

Tenant referencing can sometimes present challenges that complicate the screening process. One of the most common issues is dealing with incomplete applications or falsified information. It’s not unusual for potential tenants to omit previous addresses or alter employment details to appear more favorable. To counteract this, it’s essential to verify all provided information meticulously, using third-party services when necessary to ensure authenticity.

Another challenge is handling applicants with little to no rental history, such as first-time renters or recent graduates. In these cases, looking at alternative data like educational background, current employment status, or even requiring a guarantor can help make informed decisions. Remember, everyone has to start somewhere, and a tenant without a rental history isn’t automatically a risk if other aspects of their application are solid.

Lastly, dealing with the sheer volume of data from various sources can be overwhelming. Organizing information systematically and using technology to assist in managing the data can greatly streamline the process, reducing errors and speeding up decision-making.

Leveraging Technology in Tenant Referencing

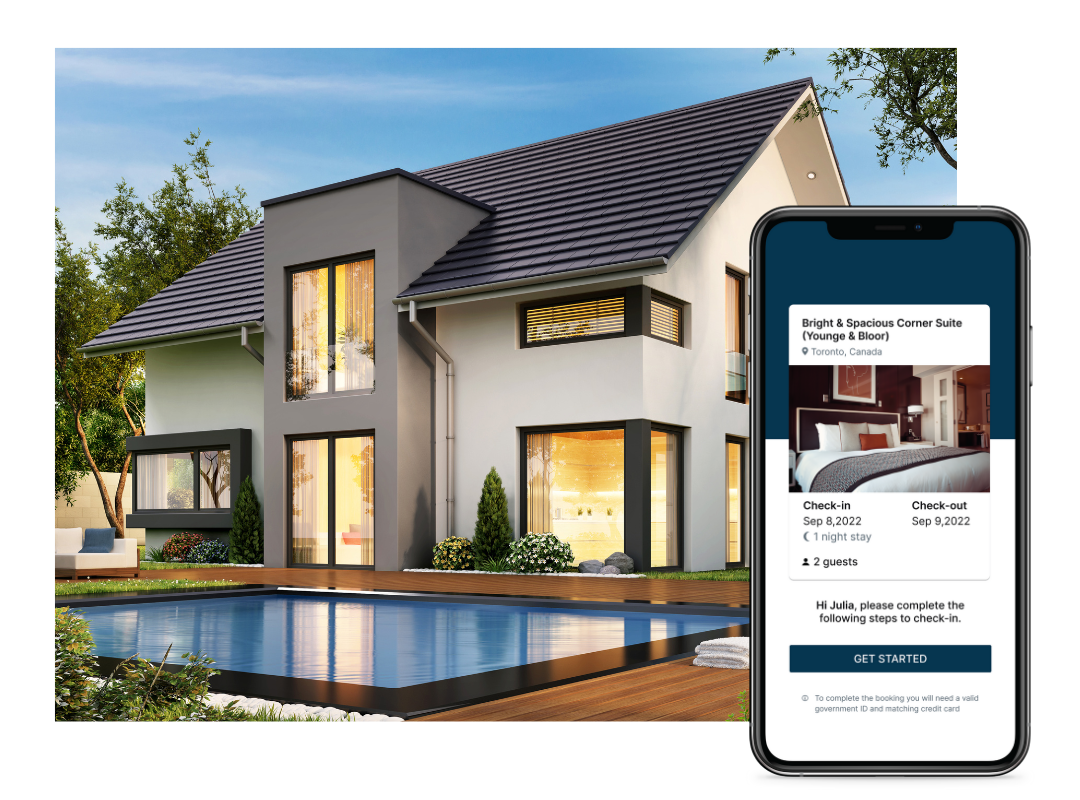

Embracing modern technology can significantly enhance the efficiency and accuracy of tenant referencing. Software solutions like Autohost offer powerful tools designed to automate and simplify the screening process. These systems can quickly pull credit reports, check criminal backgrounds, verify identities, and more—all while ensuring compliance with legal standards.

Using technology also helps maintain a uniform approach to tenant screening, which is crucial for fair housing compliance. Automated systems can store and track all applicant data securely, creating an audit trail that is invaluable in case of disputes or legal challenges. Moreover, these tools often provide additional insights that might not be as easily accessible through manual processes, such as predicting tenant reliability based on broader data sets.

Conclusion

Effective tenant referencing is a critical component of successful property management. By thoroughly understanding and implementing a comprehensive tenant screening process, you can significantly mitigate risks and improve the quality of your tenant pool. Remember, the goal isn’t just to fill vacancies but to create a stable, reliable community of tenants.

Don’t hesitate to invest in improving your tenant referencing process. Consider leveraging modern technologies like Autohost to make your workflows more efficient and compliant. With the right approach, you’ll enhance your property’s value and reputation, making it a sought-after location for prospective renters. So, take the steps needed today to refine your tenant screening efforts and set your property up for long-term success.