If you’ve ever worked in commercial real estate, you know that finding the right tenants is more than just a nice-to-have. Screening commercial tenants is your first line of defense against delays in payments and the more severe headache of evictions.

It’s not just about making sure they can pay the rent. It’s about ensuring they’re right for your property, aligned with your values, and capable of maintaining a professional work environment.

Screening commercial tenants involves a bit more than checking if they’ve got the cash. It’s a deep dive into their business’s health, history, and habits. Think of it as a form of business matchmaking where you’re looking for a tenant that not only meets your criteria but exceeds them, ensuring a profitable and stress-free partnership for both parties.

Understanding Commercial Screening

Commercial screening might sound complex, but it’s essentially about gathering as much relevant information as possible to make an informed decision. Unlike residential screening, which focuses heavily on personal credit scores and rental history, commercial screening puts the spotlight on the business itself. It encompasses everything from the business’s financial stability and creditworthiness to its reputation and operational history.

This process is like putting together a puzzle. Each piece of information you collect helps you see the bigger picture more clearly. And in the commercial world, missing even one piece can mean the difference between a thriving business relationship and a problematic tenant.

The Foundations of Commercial Tenant Screening

Before you even start the screening process, it’s crucial to know what you’re looking for. Setting clear, non-negotiable criteria for your potential tenants is step one. This could range from their ability to pay rent, based on their financial records, to their business model aligning with your property’s image and the surrounding community.

However, it’s not just about what you want. The law has a say in it too. The commercial real estate game comes with its own set of rules and regulations, and it’s vital to play by them. This means ensuring your screening process doesn’t discriminate unlawfully and adheres to all applicable fair housing laws. Remember, a lawful screening process is a smooth screening process.

Moreover, considering professional screening services can be a game-changer. These services do the heavy lifting for you, digging into the nitty-gritty details of a business’s background, financial health, and operational history. Think of them as your personal detective agency, one that specializes in sniffing out the best commercial tenants.

Commercial Tenant Background Check

Now, let’s get into the meat of the matter: the commercial tenant background check. This isn’t just a cursory glance at their business card; it’s a comprehensive look into their business’s soul. You want to know who you’re dealing with, and this means looking at their business history, reputation, and past leasing experiences.

A thorough background check can reveal a lot about a potential tenant. Have they consistently paid their rent on time in the past? Do they have a history of disputes with landlords or other tenants? What’s the general consensus on their business practices within their industry? These are the types of questions you’ll find answers to, helping you gauge whether they’re the kind of tenant you want in your property.

Moreover, this step is about verifying the information they’ve provided. It’s easy for a business to look good on paper, but the background check is where you’ll confirm whether their claims hold up under scrutiny. It’s about looking beyond the surface, ensuring there are no red flags or warning signs that could spell trouble down the line.

Commercial Tenant Credit Check

Alright, we’ve talked about who they are and what they’ve done. Now, let’s talk money. A commercial tenant credit check is your financial flashlight, shining a bright light on a business’s financial health. It’s like checking the pulse of their financial heart, ensuring they’ve got the stamina to commit to a lease and keep up with the rent.

Understanding a commercial credit report might seem like you need a degree in economics, but it’s actually more straightforward. You’re looking at their credit score, sure, but also diving deeper into payment histories, existing debts, and their overall track record of managing finances. It’s not just about a number; it’s about understanding how they handle their money, which is a pretty good indicator of how they’ll handle their rent.

When you interpret these financial indicators, you’re playing detective again. A high credit score and clean financial history are like finding gold. But, it’s not just about the highs. How they navigate financial lows can tell you a lot about their resilience and reliability. It’s all about spotting the patterns that give you confidence they’re good for their word, and more importantly, their payments.

Commercial Real Estate Tenant Screening Process

By now, you’re probably thinking, “Great, I’ve got the tools, but how do I put this all into action?” Well, let’s break down the commercial real estate tenant screening process step-by-step. Think of it as your roadmap, guiding you from that initial “Hello” to the final handshake sealing the deal.

First up, those initial inquiries and pre-screening questions. This is your first filter, separating the serious contenders from the window shoppers. Ask about their business, their needs, and why they’re moving. This isn’t just idle chit-chat; it’s strategic questioning to gauge their fit for your property.

Next, the application process. Here, you’re collecting all the nitty-gritty details: business information, financial statements, and anything else you need to start the screening process. This paperwork might not be glamorous, but it’s the backbone of your decision-making.

Now, the real work begins. You’ve got your background checks and credit checks to conduct. This is where you dive deep, verifying all the details they’ve provided and looking for any red flags or golden nuggets of reassurance. It’s a meticulous process, but remember, it’s all about securing the best tenant for your property.

Analysing Commercial Screening Reports

So, you’ve collected all this information, conducted your checks, and now you’re staring at a pile of reports. How do you make sense of it all?

Analyzing commercial screening reports is part detective work, part strategy. You’re looking for clues and patterns that tell you whether this tenant is a safe bet.

Reading these reports, you’ll come across a lot of information, but not all of it is equally important. Focus on the key aspects: financial stability, business reputation, and rental history. These are your big three, the areas that will give you the most insight into whether they’re likely to be a reliable tenant.

But what about those red flags?

Maybe you’ve spotted late payments, a history of legal disputes, or financial instability. These are warning signs, but they’re not necessarily deal-breakers. It’s about context. If they’ve had one rough year but have otherwise been solid, that’s different from a consistent pattern of financial mismanagement.

This stage is all about weighing the good against the bad, the risks against the rewards. It’s a balancing act, using your judgement to interpret the data and make an informed decision. Remember, no tenant will be perfect, but it’s about finding the one that’s perfect for your property.

Effective Communication with Potential Tenants

So, you’ve done the detective work, and now it’s time to chat. Communicating effectively with potential tenants isn’t just good manners—it’s key to a smooth screening process. From that first inquiry to the final decision, clear communication sets the tone for your relationship.

Start by laying it all out there: your criteria, the screening process, what you expect from them, and what they can expect from you. This isn’t the time for vague hints or legal jargon. Speak plainly. If you want financial statements or references, say so. And if there are deal-breakers, make them known. This transparency helps weed out those who might not be the best fit before you dive into the screening process.

Handling rejections and approvals requires tact. No one likes being turned down, but if they’re not the right fit, it’s better for both of you to realize it sooner rather than later. Be respectful, provide feedback if appropriate, and always keep the door open for future opportunities. For those you approve, a warm welcome and clear next steps set the stage for a positive working relationship.

Leveraging Technology in Commercial Tenant Screening

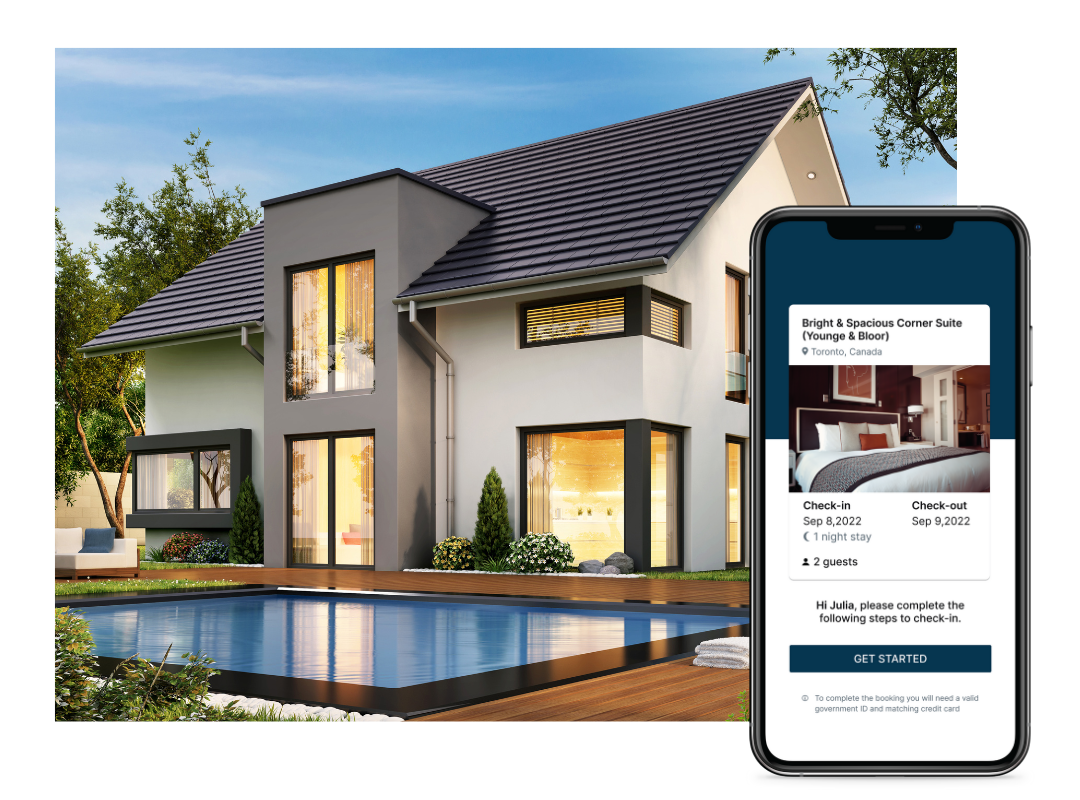

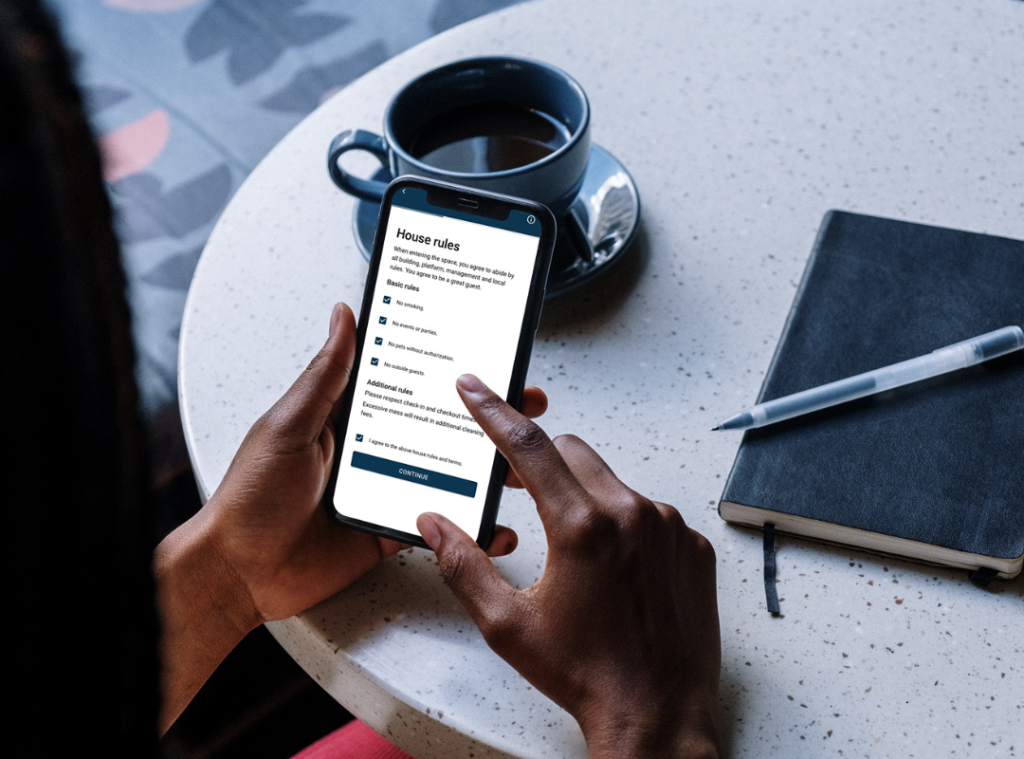

In today’s world, technology is your best friend in the tenant screening process. With a plethora of online tools and platforms at your disposal, it’s easier than ever to gather information, conduct checks, and manage applications. These tools aren’t just convenient; they’re game-changers, offering insights and efficiencies you wouldn’t have otherwise.

Imagine tapping into databases with the click of a button or using software that automates the screening process, freeing up your time for other tasks. And with companies like Autohost paving the way, you can access specialized software designed specifically for commercial screening. These tech tools aren’t just about making your life easier; they’re about making your screening process more thorough and reliable.

Maintaining a Fair and Consistent Screening Process

Let’s talk fairness and consistency, the unsung heroes of tenant screening. Sticking to a standardized process isn’t just about following the law; it’s about protecting your business and ensuring every applicant gets a fair shake.

A consistent process eliminates bias, keeps you compliant with fair housing laws, and provides a clear framework for decision-making. It’s your blueprint, ensuring every applicant is evaluated against the same criteria, regardless of their business size or industry. This level of fairness isn’t just good ethics; it’s good business, building your reputation as a trustworthy and professional landlord.

Conclusion: The Value of Comprehensive Commercial Tenant Screening

Alright, you’ve made it through the ins and outs of commercial tenant screening. From peeling back the layers of your potential tenants’ backgrounds to harnessing the power of technology, you’re now armed with the knowledge to make informed decisions. Remember, this isn’t about jumping through hoops; it’s about finding the right tenant who’s as committed to their success as you are to yours.

So, what’s next? Dive in. Start screening with confidence. Use these insights to refine your process, leverage technology, and communicate clearly. And remember, the right tenant is out there. With a thorough screening process, you’re not just filling a space; you’re setting the stage for a thriving business relationship. Ready to find your perfect match? Let’s get screened.