Short-term rentals continue to grow in popularity, making it more important than ever to implement a comprehensive property protection program. The essence of a successful Airbnb venture lies not just in attracting guests but also in ensuring the safety and security of your property. This guide delves into the various facets of property protection, designed specifically for Airbnb hosts, to shield their valuable investments from potential risks and liabilities.

The concept of property protection extends beyond the conventional boundaries of insurance and security. It encompasses a holistic approach to safeguarding your property, considering everything from guest screening to damage control. As we explore the intricacies of property protection programs, we aim to provide a comprehensive understanding of how these programs can serve as a cornerstone in the fortress guarding your Airbnb investment.

Understanding Property Protection Programs

What is a Property Protection Program?

A property protection program is a comprehensive strategy designed to shield your Airbnb property from a spectrum of risks, including accidental damage, theft, and liability issues. These programs are specifically tailored to meet the unique needs of short-term rental properties, differentiating them from traditional homeowner’s insurance policies. The primary goal of a property protection program is to provide peace of mind to property owners by mitigating the financial risks associated with renting out their space.

Purpose and Benefits

The purpose of a property protection program is multifaceted. Firstly, it serves to protect the physical integrity of your property. This includes safeguarding against damage caused by guests, natural disasters, or unforeseen incidents. Secondly, it aims to protect the financial investment of the property owner. This financial protection is crucial, considering the significant capital invested in acquiring and maintaining an Airbnb property.

The benefits of such a program are substantial. They include:

Risk Mitigation:

Reducing the likelihood of incurring significant expenses due to property damage.

Liability Coverage:

Offering protection in the event of accidents or injuries occurring on your property.

Income Security:

Ensuring a steady revenue flow by minimising downtime caused by repairs or legal issues.

Reputation Management:

Maintaining a high standard of property quality, thereby attracting more guests and positive reviews.

Property Protection vs. Traditional Insurance

It’s important to distinguish between a property protection plan and standard homeowner insurance. Traditional homeowner policies often exclude coverage for incidents that occur during commercial use, such as short-term rentals. Property protection plans, on the other hand, are designed with the Airbnb host in mind, covering gaps that conventional insurance policies might overlook.

The Essentials of a Property Protection Plan

Key Features

A robust property protection plan for Airbnb hosts should encompass several key features:

Comprehensive Coverage:

This includes protection against damage to furniture, appliances, and structural components of the property.

Liability Protection:

Coverage for accidents or injuries that may occur on the premises during a guest’s stay.

Loss of Income Coverage:

Compensation for lost revenue during periods when the property is uninhabitable due to covered damages.

Customizable Policies:

Flexibility to tailor coverage based on specific needs and property characteristics.

Benefits of a Property Protection Plan

Implementing a property protection plan offers numerous benefits:

Enhanced Security:

Provides a sense of security, knowing that your property is protected against unforeseen circumstances.

Financial Stability:

Guards against unexpected financial burdens resulting from property damage or legal liabilities.

Guest Confidence:

Increases guest confidence, as they feel secure in a well-protected rental space.

Implementing a Rental Protection Plan

When it comes to safeguarding your Airbnb investment, implementing a rental protection plan is a strategic step. This plan not only covers potential damages but also serves as a safety net, ensuring the longevity and profitability of your rental business.

Choosing the Right Plan

Selecting an appropriate rental protection plan requires careful consideration of various factors:

Coverage Scope:

Evaluate the extent of coverage provided. Look for plans that cover a wide range of potential damages, including accidental, intentional, or natural incidents.

Cost Effectiveness:

Assess the plan’s cost relative to the coverage offered. Opt for a plan that provides comprehensive protection without being prohibitively expensive.

Provider Reputation:

Research the credibility and customer service track record of the protection plan provider. A reliable provider with positive reviews and responsive customer service is vital.

Policy Flexibility:

Ensure that the plan can be tailored to suit the specific needs of your property and rental style.

Implementation Process

Implementing a rental protection plan involves several key steps:

Assessment:

Conduct a thorough assessment of your property to identify potential risks and vulnerabilities.

Comparison:

Compare different plans and providers to find the best fit for your property.

Enrollment:

Complete the necessary procedures to enrol in the chosen plan.

Integration:

Seamlessly integrate the plan with your existing property management system.

Communication:

Inform your guests about the protection plan and how it benefits them.

Best Practices

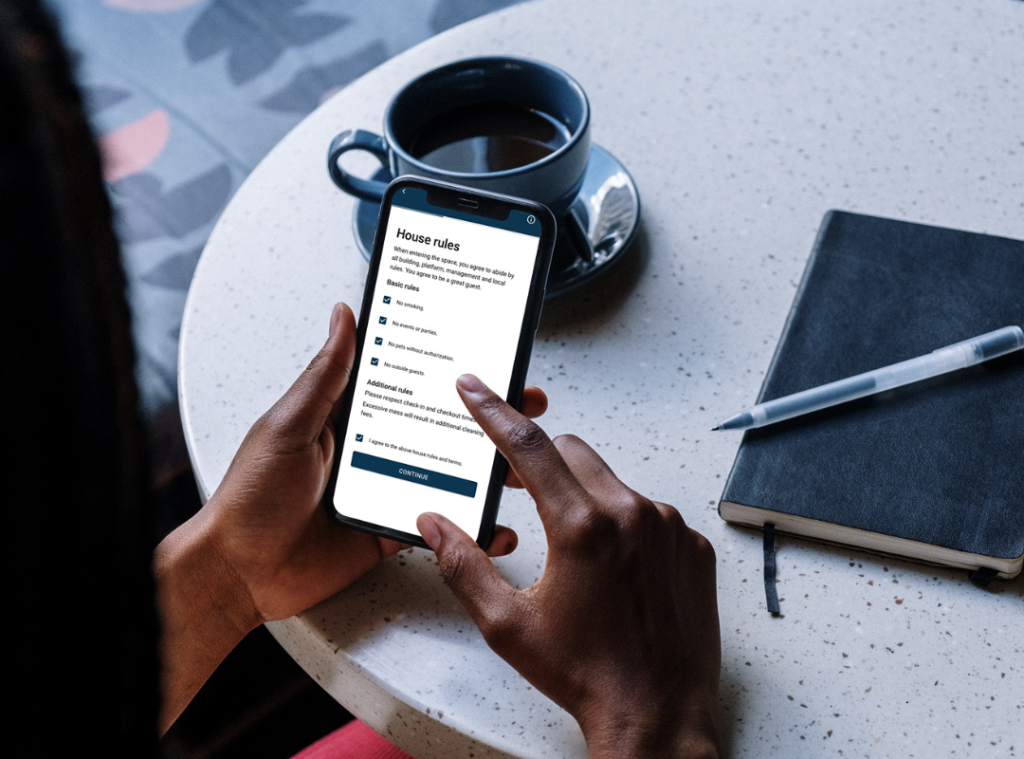

Adopting best practices ensures the effective integration of the rental protection plan:

Regular Reviews:

Regularly review and update your plan to align with changing needs and market conditions.

Guest Education:

Educate guests about the dos and don’ts to minimise risks and ensure compliance with the plan’s terms.

Documentation:

Maintain comprehensive documentation of the property’s condition before and after rentals for claim processing.

Property Protection: A Layered Approach

Beyond insurance plans, property protection should be viewed as a multi-layered strategy encompassing various elements.

Physical Security Measures

Implementing physical security measures is crucial:

Security Systems:

Install robust security systems like surveillance cameras and alarm systems.

Smart Locks:

Use smart locks for controlled access and to track entry and exit.

Regular Maintenance:

Ensure regular maintenance of the property to prevent damages and ensure safety.

Guest Screening

Effective guest screening is a key component:

Background Checks:

Conduct background checks to assess the reliability and credibility of potential guests.

Clear Guidelines:

Set clear rental guidelines and communicate them effectively to guests.

Monitoring:

Monitor guest activities to ensure compliance with house rules.

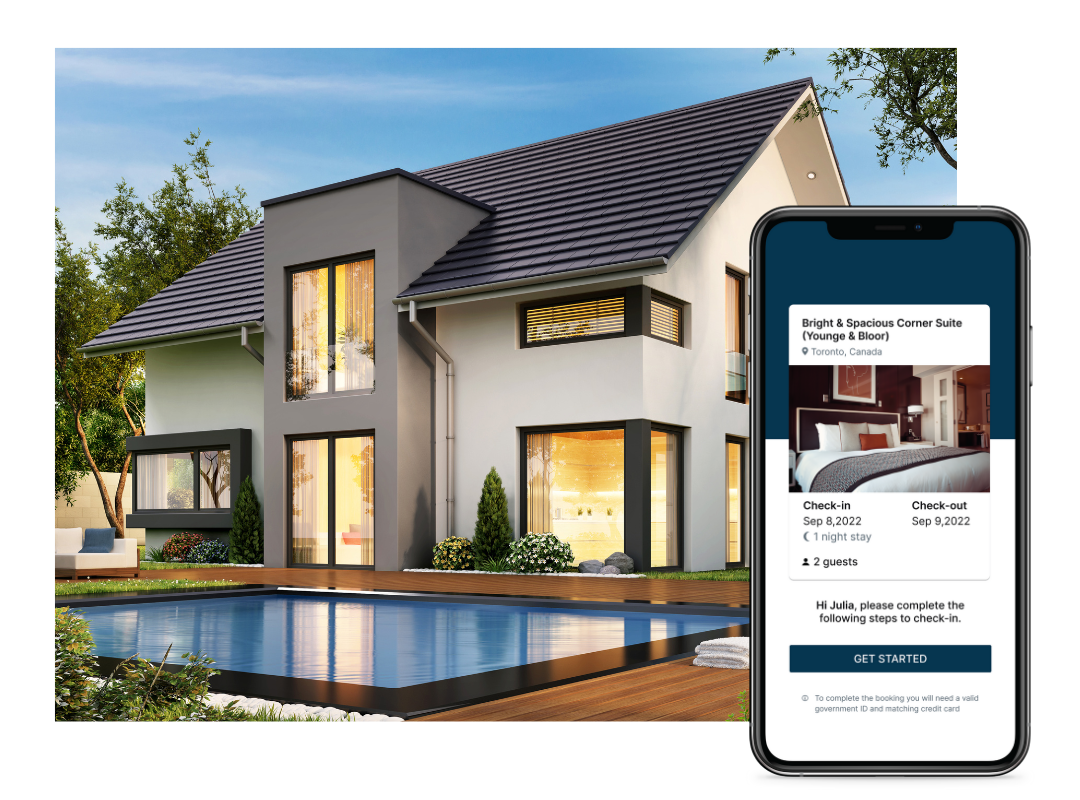

Technological Integration

Leveraging technology can enhance property protection:

Automated Systems:

Use automated systems for guest check-in/check-out and property management.

Damage Detection Technology:

Implement technologies that detect and report damages in real-time.

The Role of Property Protection Insurance

Property protection insurance plays a vital role in safeguarding Airbnb investments, offering an additional layer of security.

Understanding Property Protection Insurance

This specialised insurance covers scenarios often excluded in traditional insurance policies:

Guest-Related Damages:

Coverage for damages caused by guests, which may not be covered under standard homeowner policies.

Short-Term Rental Specifics:

Tailored to address the unique risks associated with short-term rentals.

Benefits Over Homeowner Insurance

Property protection insurance offers distinct advantages over standard homeowner insurance in the context of Airbnb hosting:

Tailored Coverage:

Specifically designed to cover short-term rental risks.

Flexibility:

Offers more flexibility in terms of coverage limits and terms.

Guest Injury Protection:

Includes liability coverage for guest injuries, which is crucial for Airbnb hosts.

Maintaining and Updating Your Property Protection Program

An effective property protection program is not a set-and-forget solution. Regular maintenance and timely updates are essential to ensure that your Airbnb investment remains secure and adapts to changing circumstances.

Regular Review and Adaptation

Assessing Changes in Risk

– Regularly assess any changes in the risk profile of your property.

– Consider factors like local crime rates, natural disaster patterns, or changes in guest demographics.

Updating Coverage Limits

– Review and adjust your coverage limits and terms based on property value fluctuations or increased guest traffic.

Staying Informed

– Keep abreast of new trends in the hospitality and insurance industries.

– Attend workshops or webinars, and subscribe to relevant publications to stay informed.

Proactive Upgrades

Technology Integration

– Continuously explore technological advancements that can enhance property security and guest experience.

– Consider integrating smart home devices for better control and monitoring.

Feedback Incorporation

– Use guest feedback to identify areas of improvement in your protection plan.

– Regularly update your property based on constructive feedback to minimise future risks.

Conclusion

In a dynamic and competitive industry like Airbnb hosting, an up-to-date and comprehensive property protection program is not just a safety net—it’s a cornerstone of your business’s success and sustainability. By investing time and resources in a well-structured property protection program, you ensure the longevity and profitability of your Airbnb investment.

Remember, protecting your property is an ongoing journey, not a one-time event. Stay vigilant, stay informed, and continuously adapt your strategies to meet the evolving demands of the short-term rental market. Embrace the peace of mind that comes from knowing your Airbnb is well-protected, and let that confidence shine through in every guest interaction.